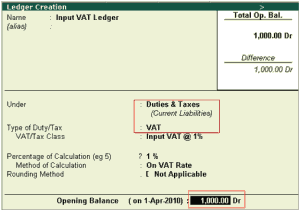

How to provide the opening balance for Input Tax Credit in a new Company?

Yes, it is possible to provide the Opening Balance for Input Tax Credit in a newly created company by giving the amount in the Opening Balance field followed by Dr for the Input VAT Ledger grouped under Duties & Taxes and Type of Duty/Tax as VAT. The opening balance will be displayed in the VAT Computation and the respective Forms. Selection of Vat/Tax class is optional.