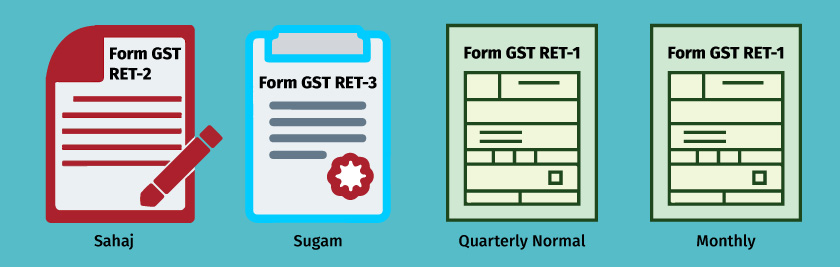

By Introducing different return forms for different types of business, the new GST return system aims to simplify the filing process for business registered under GST. Sahaj GST return is one such form among the several types of new GST returns to be introduced.

In this blog, let us understand all about the Sahaj GST returns right from its applicability, periodicity of return filing, payment of tax and return filing process.

What is Sahaj return in GST?

Sahaj is a type of GST returns for small taxpayers whose aggregate turnover in the financial year does not exceed 5 Crores and their outward supplies are of B2C nature i.e. outward supplies are made to end consumers and unregistered business.

Applicability of Sahaj return

The criteria to decide on the applicability of the return depends on the aggregate turnover and types of outward supplies you make.

- The aggregate turnover in the previous financial years is up to 5 crores

- You are engaged in making only B2B supplies (Unregistered Business and end consumers)

If you satisfy the above two conditions, you will have an option to file Sahaj GST returns.

Periodicity of filing Sahaj return

The periodicity of Sahaj return filing is on a quarterly basis. However, the payment of tax should be made on a monthly basis.

For businesses opting Sahaj GST return, the due date to file a quarterly return is 25th of the subsequent month following the quarter-end. Following are due date for filing Sahaj returns.

| Due Date to File Sahaj GST Return | |

| Quarters | Due Data |

| April -June | 25th July |

| July – September | 25th October |

| October- December | 25th January |

| January-March | 25th April |

Due date for payment of tax

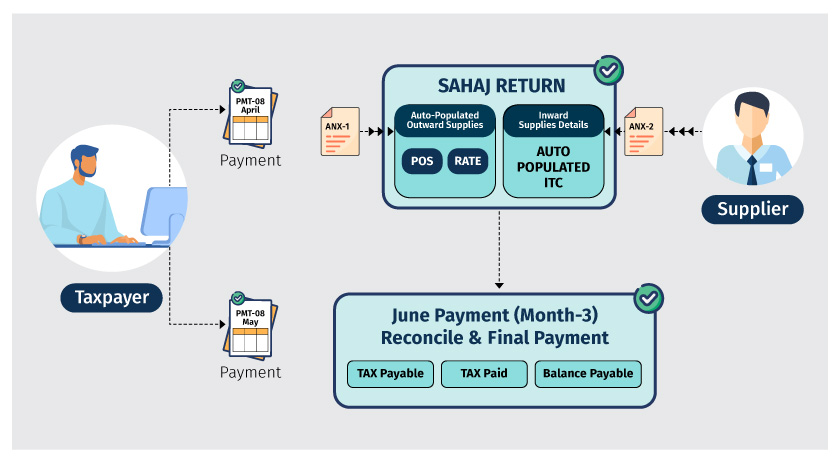

Taxpayers opting Sahaj return are required to make the monthly payment though the return filing periodicity is quarterly. The payment of tax is on the self-assessed basis and should be made through a payment declaration form known as Form GST PMT-08. The due date for monthly payment of tax for Sahaj return is 20th of succeeding month.

The self-assessed payment is required only for 1st and 2nd month of the quarter and for 3rd month, payment along with all adjustments should be made along with the returns.

Sahaj return filing process

The Sahaj GST return consist of one main return, to be filed on a quarterly basis supported by two main annexures. Form GST RET-2 is the return form to be used to file Sahaj returns supported by the annexures.

The details of return forms and annexures to be used for filling Sahaj return is given below.

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-2 | Form RET-02 is a quarterly return applicable for business opting Sahaj returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |