Tally.ERP 9 Release 6.4 is our latest product for businesses, launched on 23rd Feb. 2018.

If you are a business owner, do you need to upgrade to this release? If you are a tax consultant, must you ask your clients to upgrade? These are some obvious questions in your minds.

In this blogpost, we will take you through the benefits of using Release 6.4. We are confident that by the time you have finished reading this blogpost, you will have all your doubts cleared.

Release 6.4 addresses two important needs of our customers. E-Way Bill management and GST compliance for composite dealers.

Enhancements in Tally.ERP 9 Release 6.4

1. e-Way Bill Management

If you are a business owner, e-Way Bills are going to become bigger part of your daily life sooner than you expect. If you are transporting goods worth Rs. 50,000 or more and beyond the distance of 10 kms or more, you can do so only with an e-Way Bill.

As enablers of GST compliance for businesses, we have introduced e-Way Bill Management in Tally.ERP 9. Let’s walk through the important benefits of using Tally.ERP 9 for managing your e-Way Bills.

Generate e-Way Bills quickly

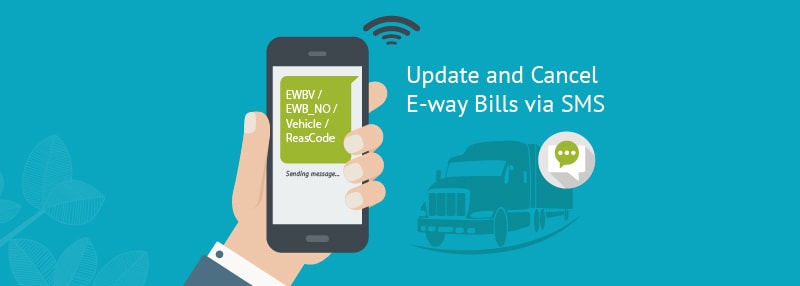

Tally.ERP 9 makes your life simpler! While creating an invoice, as soon as you start keying in the details, Release 6.4 allows you to capture additional transportation related details at the same time. You can export the invoice in a JSON file and upload it on the e-Way Bill portal to generate the e-Way Bill. The e-Way Bill Number (EBN) appears on the e-Way Bill along with other details.

You can enter the EBN against the corresponding invoice in Tally.ERP 9, take a print and hand it over to your transporter.

With Tally.ERP 9, you don’t have to re-enter all the invoice details again on the e-Way Bill portal for the purpose of generating e-Way Bill and save valuable time while reducing operational effort.

Create e-Way Bills for single or multiple invoices

Let’s take a case where you have received multiple orders and prefer to dispatch them together. Tally.ERP 9 allows you to easily generate e-way bills for all these invoices in one go. With latest version of Tally.ERP 9, you can export for all these invoices together at one go, rather than generating individual JSON files for each single invoice.

Tally.ERP 9 gives you the flexibility to generate e-Way Bills as per your business behaviour.

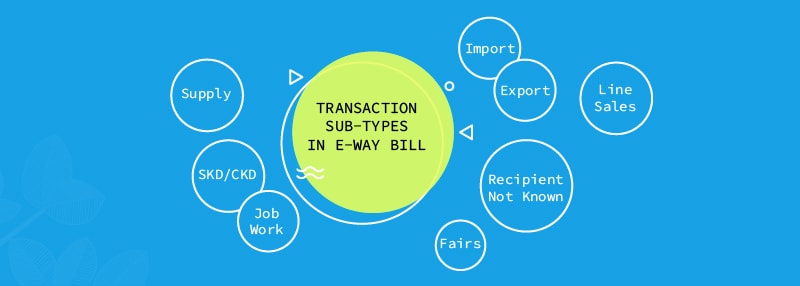

Create e-Way bills for different business scenarios

As a business, you come across different scenarios on a day-to-day basis. Sometimes, your supplier may not be able to generate an e-Way Bill. You might have made a purchase from an unregistered dealer who is unable to generate the e-Way Bill. If you are returning back some goods to your supplier, then you must have an e-Way Bill. Tally.ERP 9 gives you the flexibility to deal with all such scenarios and generate e-Way Bills under any circumstances.

You can also export JSON files of purchases, credit notes, delivery notes and receipt notes to generate e-Way Bills.

Track and manage transactions which need e-Way Bills

If you have hundreds of transactions, it can be difficult to keep a track of all those which qualify for e-Way Bills. No more worries! Tally.ERP 9 identifies transactions for which e-Way Bills are yet to be generated.

You can also find out invoices with missing information from the e-Way Bill Report and fill in the necessary information. You can update transactions with missing EBNs under Update e-Way Bill Information tab.

Generate Consolidated e-Way Bill

The e-Way Bill portal allow you to generate a consolidated e-Way Bill if the place of supply, State, mode of transport and vehicle number are the same. You can group invoices accordingly in Tally.ERP 9, generate a consolidated JSON and upload the same to the portal for generating a consolidated e-Way Bill. However, before doing this, ensure that you have generated e-Way Bills for each invoice individually which is a prerequisite.

Another important need that we addressed in latest version of Tally.ERP 9 is GST compliance for Composite Dealers.

2. GST Compliance for Composite Dealers

If your business turnover is equal to or less than Rs.1.5 crores, then you can opt for the Composition Scheme. Although the burden of tax compliance is lesser if you are a composite dealer, you still have to file GSTR-4 on a quarterly basis and follow some simple steps for compliance.

Tally.ERP Release 6.4 is a seamless GST solution for composite dealers. You can maintain books, configure tax rates, generate Bill of Supply, manage reverse charge transactions and generate GSTR-4 in JSON for filing. Below are the business benefits of using Tally.ERP 9 Release 6.4 for Composite dealers.

Configure tax rate in a single step

A flat tax rate of 1% is applicable for manufacturers and traders under the Composition Scheme. It takes just a step to configure the tax rate in your Tally.ERP 9 at the company level. Tally.ERP 9 calculates tax liability on your total taxable turnover.

We all know that tax rates can change under the GST regime. In such cases, you can apply the new applicable tax rate and maintain earlier transactions with their tax history in Tally.ERP 9. Let us understand this better by way of an example.

Assume that a tax rate of 2% is applicable from 1st April to 20th May, while 1% tax rate will be applicable from 21st May to 30th June. Tally.ERP 9 will automatically consider both the tax rates along with their applicable dates in your GSTR-4.

Segregate taxable, nil rated and exempted sales

As per the latest notification of CBEC (Central Board of Excise & Customs), composite dealers have to pay tax on their taxable turnover. To arrive at the right amount of taxable turnover, as a composite dealer, you must segregate the sales into taxable, nil rated and exempted sales. Tally.ERP 9 takes care of this when calculating tax liability on taxable turnover.

Record your purchases in the right manner

As a composite dealer you cannot claim any Input Tax Credit on purchases, yet have to pay taxes. Now these taxes have to be factored in under purchase cost.

With Tally.ERP 9 Release 6.4, firstly you can define the amount of tax in the Item Master. Secondly, this tax amount gets allocated to your purchase cost. This reflects in your Stock Summary Cost under the Stock Summary Report. Although the tax rates are configured for each item, Tally.ERP 9 ensures that the rates get applied only when you make purchases and not when you engage in any sales.

Manage reverse charge transactions

A composite dealer is liable to pay reverse charges in case of specified purchases and import of services. With Tally.ERP 9 Release 6.4, you can record such transactions easily and their impact reflects in your GSTR-4, provided you raise tax liability using the Stat Adjustment feature.

Generate and print Bill of Supply

Composite dealers have to issue Bill of Supply instead of invoices for all their sales. With Tally.ERP 9 latest version, you can prepare Bill of Supply as per GST defined format and issue them for sales.

File GSTR-4 using Tally.ERP 9

Composite dealers have to file GSTR-4 on a quarterly basis. If there are any errors in transactions, Tally.ERP 9 detects and helps you to correct them while you prepare the data for GSTR-4. You can easily generate GSTR-4 in a JSON format, which can be uploaded on GST Portal to file the returns.

Release 6.4 has many more rich capabilities to help you manage your GST compliance better. We would like to hear from you, especially your experience of this release. Do upgrade, use the latest version and also share with your business colleagues so that everyone is able to make use of the benefits of our latest Tally.ERP 9 Release 6.4.

Click here for release notes

Click here for download