Definition of income statement

The income statement presents information on the financial results of a company’s business activities over a period of time.

It communicates to users how much revenue the company has generated during the period and the cost incurred by it in connection to generating such revenues. Income Statement is also called by different names as “statement of operations†or “statement of earnings†or “profit and loss statementâ€.

Business engaged in services usually prepare income statement instead of profit & loss a/c. While the objective remains the same, owing to the difference in the nature of business, few components are different in the income statement.

Components of income statement

Revenue

Revenues are the amounts from the sale of goods and services in the normal course of business. And net Revenue means all proceeds from the sale of goods and services excluding the returns.

For example, Zen Phones, an electronic store selling phones and computers. This implies that Company A is in the sales business and its revenue is from the sale of computers and mobile phones.

Let’ take another example.

Max associates is a law firm rendering consultancy services to their clients. Here, they are engaged in the business of rendering services for which it charges a fee. So here fee is the revenue forming part of Income Statement.

However, there are also other forms of revenue such as interest income, royalty income, rental income etc. that will be part of the statement.

Expenses

Expenses are the amounts incurred to generate revenue and includes the cost of rendering services such as operating expenses, interest payments, rent, salaries and wages, taxes etc.

For example, Max associates is a law firm providing legal consultancy services to its clients.

In the process of rendering services, the company will incur various expenses such as promotional expense (advertisement expenses), sales managers’ salaries, depreciation on usage of fixed assets and other administrative expenses to earn revenue by rendering services. All these expenses form part of the income statement as they are incurred in relation to such revenues.

Net Income

Here, the net income is nothing but an excess of revenue over the expenses. In other words, after deducting all the expenses and taxes from the revenue earned during the period, remaining is the net income from the business operation.

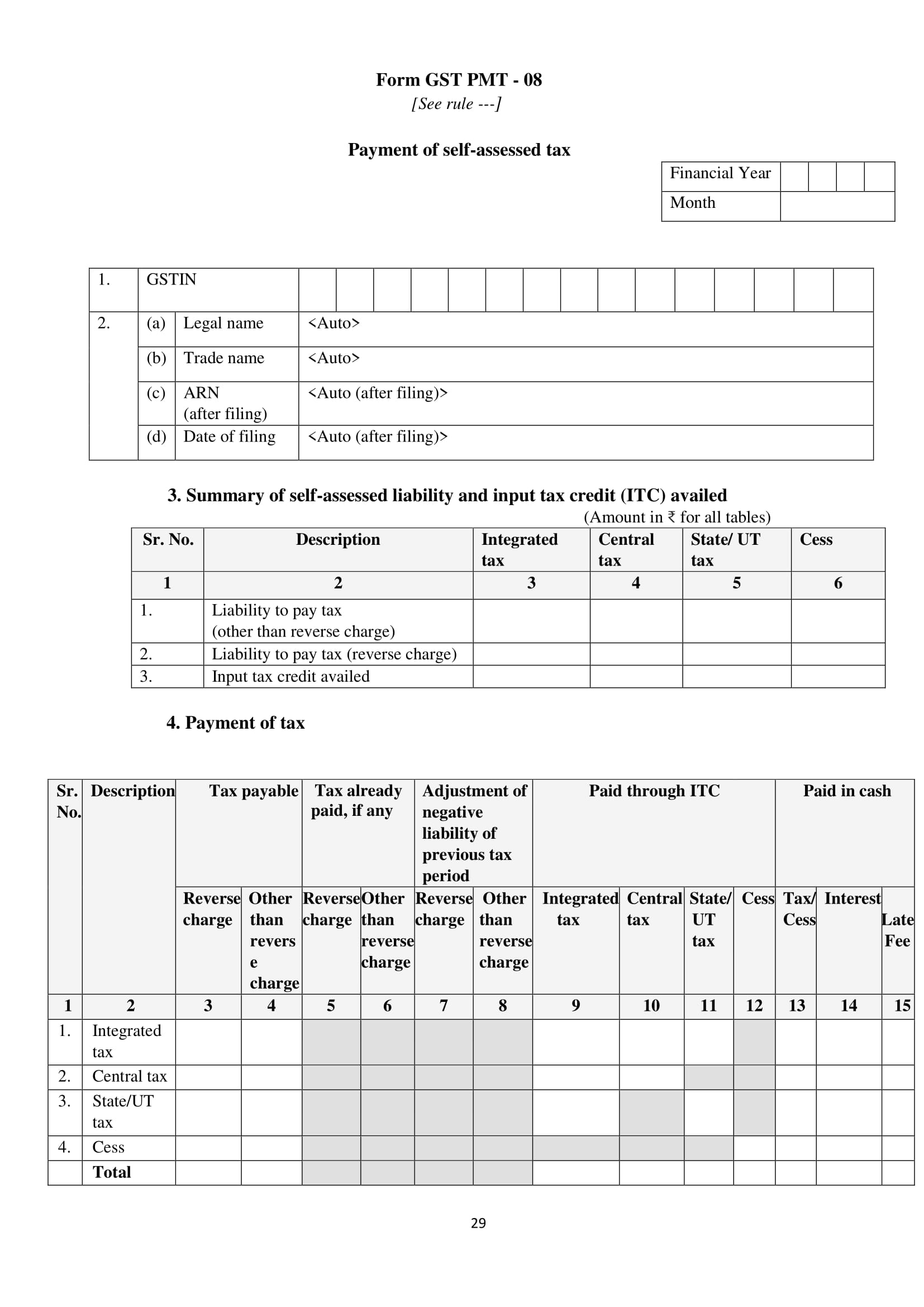

A format of an income statement is very important as it is the means of communication of operating results to outsiders. The income statement format includes details such as the company’s name, the title stating, “Income Statementâ€, the period covered, and other key components as discussed above.

| Company Name

Income Statement

For the period ______ |

| Particulars |

Amount (Rs.) |

Amount (Rs.) |

| Revenues

Service revenue/revenue from sale of goods/royalty/rental/interest income/commission income etc. |

|

xxx |

| Expenses

Salary expense

Rent expense

Depreciation expenses

Office expenses

Bank charges

Interest expense

Total Expenses |

xxx

xxx

xxx

xxx

xxx

xxx |

xxx |

| Profit before taxes (Revenues – Expenses) |

|

xxx |

| Tax Expense |

|

xxx |

| Net Profit or Net Income (Profit before taxes – taxes) |

|

Xxx |

Single-step income statement format

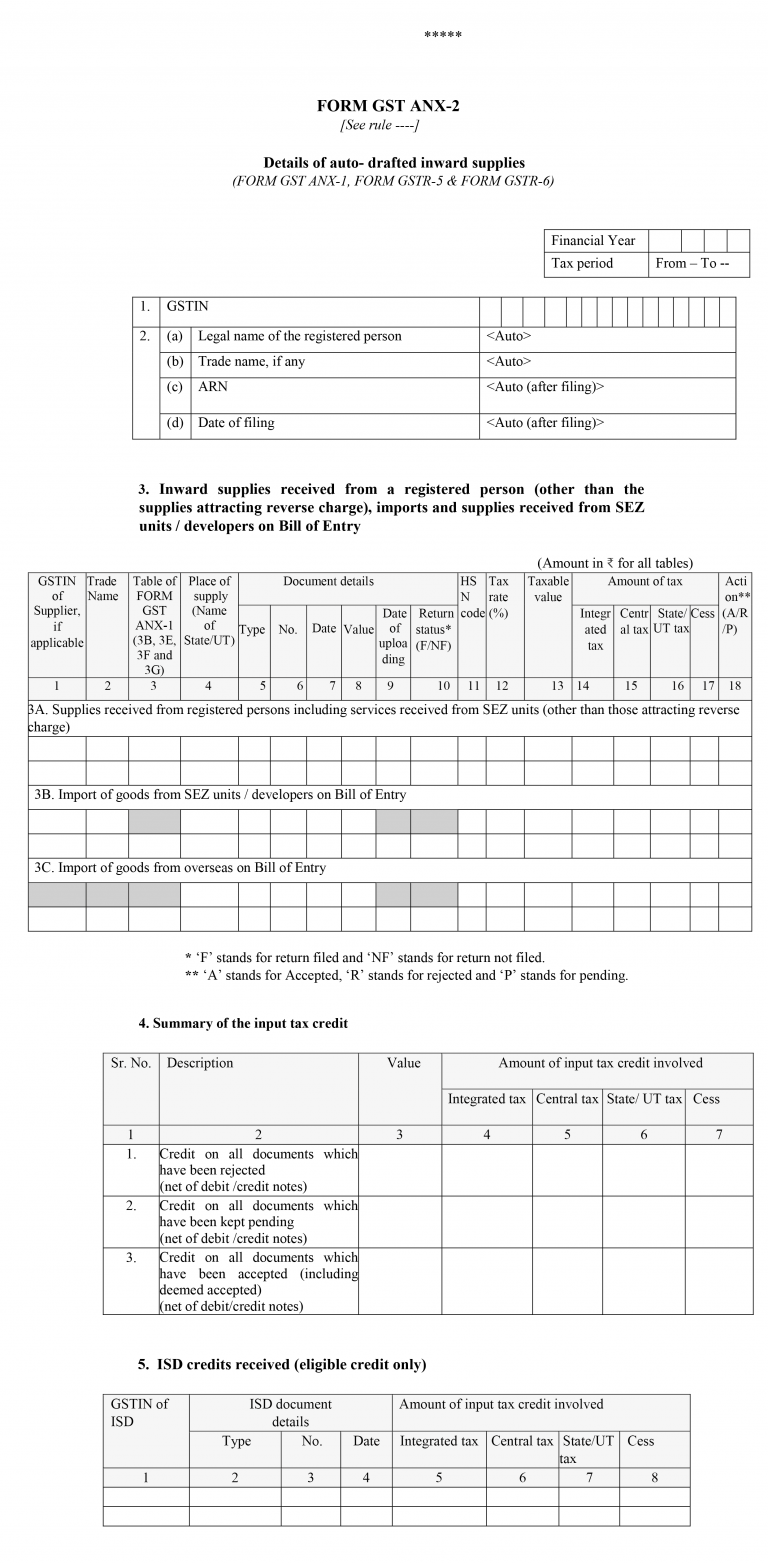

Income statement example

Below is the income statement example of Max Associates, who are into legal consultancy service.

| Max Associates

Income Statement

For the period 1-4-2019 to 31-3-2020 |

| Â Particulars |

Amount (Rs.) |

Amount (Rs.) |

| Revenues

Revenue from legal consultancy fee |

|

25,00,000 |

| Expenses

Salary expense

Rent expense

Depreciation expenses

Office expenses

Bank charges

Interest expense

Total Expenses |

2,00,000

1,80,000

30,000

20,000

12,000

8000 |

4,50,000 |

| Profit before taxes (Revenues – Expenses) |

|

20,50,000 |

| Tax Expense |

|

3,00,000 |

| Net Profit or Net Income (Profit before taxes – taxes) |

|

17,50,000 |

Why do businesses prepare income statements?

We must mainly remember one thing that a company does not operate wholly on owned funds, it borrows money from outsiders to run its operational activities.

So, the external users of income statement i.e. investors, creditors and other lenders must make decisions about resource allocation as where to put their money. They use the income statement to find out answers for the questions they may have about the future profitability of the business.

- For investors – This statement will help them to decide whether to keep or sell the shares they own in the company. The investors also use the income statement to determine the ability of a company to pay dividends.

- For lenders – Lenders use the income statement to find out whether the company will be able to repay the loan with interest in the future.

- Creditors – They use the income statement to determine whether the company will be profitable enough to repay their debts as they come due.

How do businesses prepare income statement?

With the help of ERP software, preparing an income statement is made a lot easier. Gone are those days where you need to wait for the closure of books to determine the net income. Today, most businesses have automated the preparation of various financial statement including income statement using ERP software or accounting software.

Usage accounting software has helped the business owners to frequently check the income statement and accordingly take the corrective actions as when required.