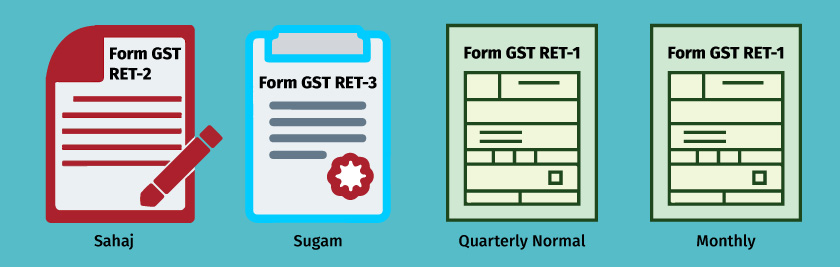

In the 31st meeting of GST Council, it was recommended to introduce and implement a new GST return system. One of the key aspects of the new GST return system is the introduction of different types of return forms considering the business profile. Quarterly return form RET-1 is one such return type designed for small taxpayers.

In this blog, let us understand the applicability, return filing period and format of quarterly return form RET-1

What is quarterly return form RET-1?

Quarterly Return form RET-1 is a return type for small taxpayers whose aggregate turnover in the financial year does not exceed 5 Crores and their outward supplies consist of B2B B2C and all other types supplies such as exports, SEZ etc.

To put it in simple words, businesses opting quarterly return form RET-1 will be allowed to make all types of outward supplies such as supplies to end consumers, unregistered business, registered business, exports, SEZ etc.

Except for the periodicity of filing return, the form type, format and details required to be furnished are similar to monthly returns.

Periodicity of filing quarterly return form RET-1

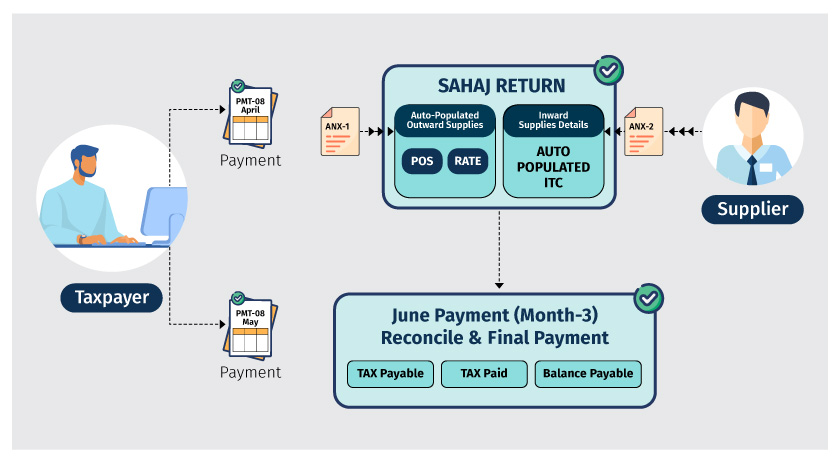

The periodicity of filing quarterly return form RET-1 is similar to the Sahaj and Sugam. You need file the returns quarterly with a monthly payment of tax on a self-assessed basis. The due date to file a quarterly return in Form RET-1 is 25th of the subsequent month following the quarter-end.

The due date for filing Sugam GST returns is given below

| Quarterly Return Form RET-1 | |

| Quarters | Due Data |

| April -June | 25th July |

| July – September | 25th October |

| October- December | 25th January |

| January-March | 25th April |

Due date for payment of tax

Though the return filing periodicity is quarterly, businesses opting quarterly RET-1 are required to make the monthly payment.

The tax payment is on the self-assessed basis and the payment declaration challan known as Form GST PMT -08 should be used to remit the payment. The due date to remit the monthly payment is 20th of the subsequent month.

Types of supplies allowed under quarterly GST Return Form RET-1

Business opting quarterly return Form RET-1 will be allowed to make all types of supplies as mentioned in the below table.

| Type of Outward Supplies | Allowed (Yes) / Disallowed (No) |

| B2B transactions | Yes |

| B2C transactions | Yes |

| Exports | Yes |

| SEZ units/developers | Yes |

| Deemed Exports | Yes |

| Outward Supply to e-Commerce Operators | Yes |

| Nil Rated, Exempted or Non – GST | Yes |

| Inward supplies attracting RCM | Yes |

| Import of goods/services | Yes |

| Import of Goods from SEZ | Yes |

Difference between Sahaj, Sugam and quarterly return form RET-1

All these returns are quarterly and designed for small taxpayers. The first difference, the obvious one is that each of these returns differs basis nature of supplies it supports. Sahaj supports only B2C supplies, Sugam supports B2C as well as B2B supplies and quarterly return form RET-1 support all types of supplies.

Second, the most important one, the facility of availing ITC on the missing invoice (invoices not uploaded by the supplier) and reporting of such bills is allowed for businesses opting monthly return and quarterly return in form RET-1. In other words, businesses who have opted Sahaj return and Sugam return will not be allowed avail ITC on the missing invoice.

Quarterly return form RET-1 return filing process

The quarterly return form RET-1 consist of one main return, to be filed on a quarterly basis supported by two main annexures. Form GST RET-1 is the return form to be used to file Sugam returns supported by the annexures.

The details of return forms and annexures to be used for filling Sugam return is given below.

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-1 | Form RET-1 is a quarterly return applicable for business opting Sugam returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |