The new Tally.ERP 9 Release 3.2 is available now!

FREE for all users of Tally.ERP 9.*

Tally.ERP 9 is the latest offering of the Tally software series. As with all Tally products, rapid updates are made available for the lifetime of the product via periodic releases, thereby providing the high level of business capability that millions of users trust. Highlights include a very light product footprint, immediate access to new features and enhancements, easy data migration and more.

Major Enhancement :

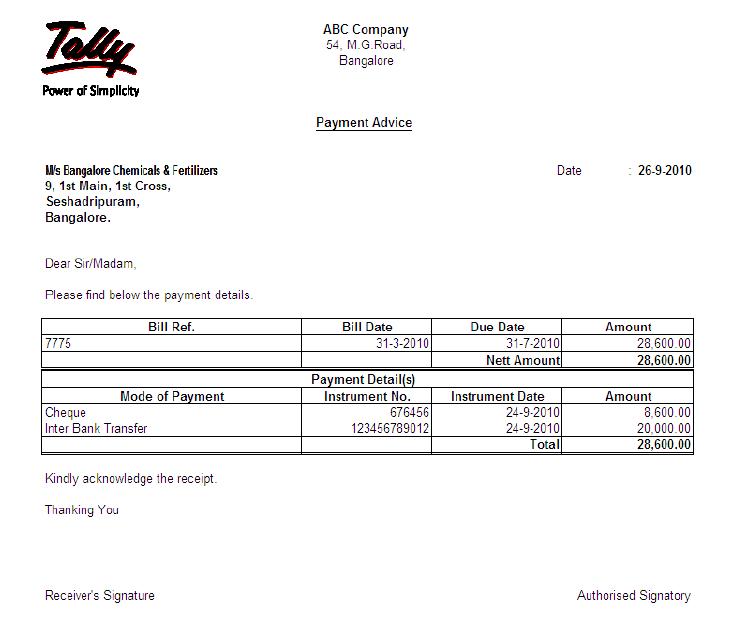

Banking : The facility is provided to print the cheque with the date format – DDMMYYYY for a better user experience. The same can be configured from Cheque Printing Configuration screen by selecting applicable Style of Date format

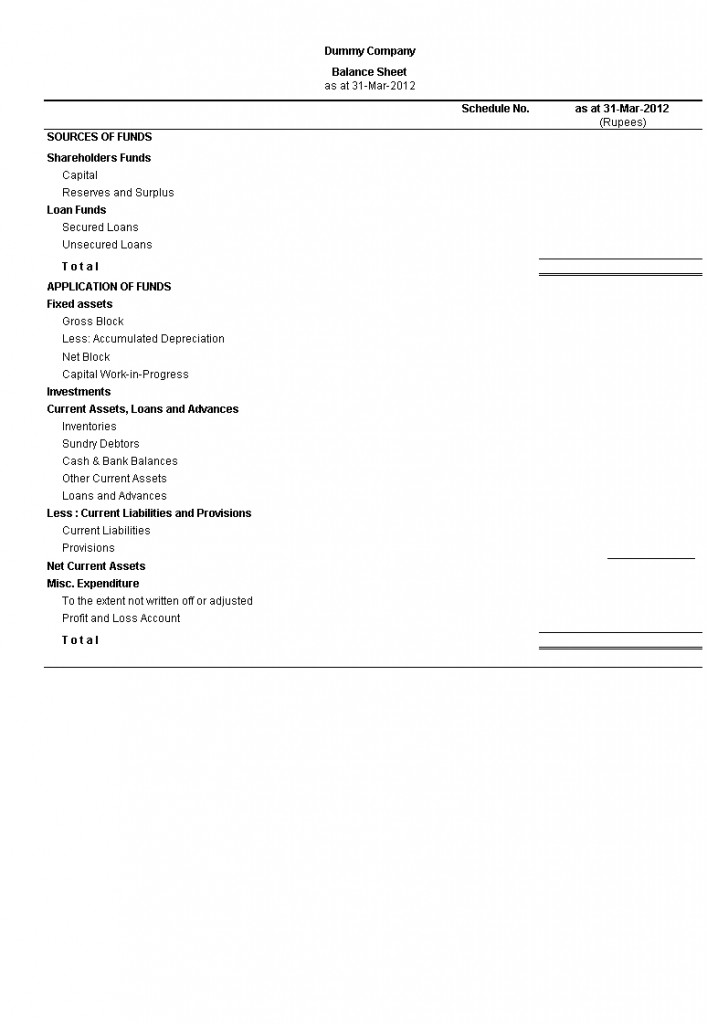

Final Accounts : In the default Balance Sheet report the S: Schedule VI button (Alt+S) is provided to generate Balance Sheet as per the Schedule VI format of the Companies Act. In the default Profit & Loss Account report the S: Schedule VI button (Alt+S) is provided to generate Profit & Loss Account as per the Schedule VI format of the Companies Act.

Service Tax : As per Notification, the new Point of Taxation Rule (from 1-4-2011) will not be applicable on specified services viz., Chartered Accountant, Cost Accountant, Company Secretary, Architect, Interior Decorator, Legal and Scientific and Technical consultancy services if the

service provider is Individuals, Proprietary Firms and Partnership Firms. The functionality is enhanced to meet the requirements of Point of Taxation Rule.

Excise for Manufacturers : In Excise Payment voucher, the payment type – Arrears is provided to make payments towards arrears and adjust it against the required bills in the Excise Duty Allocation screen.The facility is provided to generate Tariff wise Daily Stock Register for items having same Reporting Unit of Measure

Licensing : On performing Try/Buy/Download operation from Market Place, the messages – Restarting Tally and License Updated Successfully are not displayed. This is done to minimise the number of messages for a better user-experience

And more……

The highlights of this release are listed below.

- Facility to record Working Notes and generate Audit Working Papers

- Track Transactions on Holidays & Weekly Offs

- Percentage report of sample size for substantive test

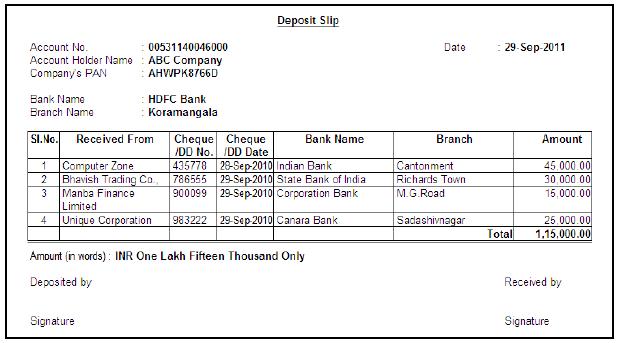

- Inter Bank Transfers Visibility

- Tracking for Unadjusted Advances

- Facility to track Accounts squared off during the year

- Facility to track Highest & Lowest Value Transactions

- Checklist of Accounting Standard (AS) Compliance

- Checklist of Audit & Assurance Standard (AAS) Compliance

- Schedule VI format of Balance Sheet and Profit & Loss A/c. as per Companies Act.

- Option to retain Bank date has been provided on altering the Reconciled Voucher.

- Excise for Manufacturers – Facility to generate Tariff wise Daily Stock Register for items having same Reporting Unit of Measure

- The Style of Date ‘DD/MM/YYYY’ has been provided for Printing Cheques, as per the NPCI format.

Tally.ERP 9 Feature Summary:

- Quick to install and allows incremental implementation

- Easy to customise

- Powerful remote capabilities to boost collaboration

- Audit & compliance services

- Integrated support centre

- Security management

- Statutory processes

- Manufacturer’s excise

- Payroll

Click here for release notes

Click here for download