Tally Software

Purchasing of Tally.ERP 9 Multiuser or Single User Software

TallyPrime Release 2.0

Release Notes – What’s New in TallyPrime

You can count on us for a delightful journey with TallyPrime as we work to enhance the product with new features and fix issues, which will make your experience even simpler and more seamless.

Highlights – TallyPrime Release 2.0

Connected experience for e-Way Bill

With the connected experience for e-Way Bill, TallyPrime enables you to –

- Generate e-Way Bill online at the time of voucher creation.

- Generate multiple e-Way Bills online at one shot.

- Cancel e-Way Bill, update Part B & Transporter ID, and extend validity for transactions in bulk.

- Print e-Way Bill for invoices with e-Way Bill number and QR Code as per the government’s requirements.

- Track the status of e-Way Bills using the e-Way Bill report and e-Way Bill Register.

- Get the latest e-Way Bill information and status from the e-Way Bill system to a transaction using e-Way Bill report and e-Way Bill Register.

As a result, you need not juggle between TallyPrime and the e-Way Bill system for various e-Way Bill activities, as everything can be done from within the product.

Save View for reports

The Save View feature will delight you with a personalized experience for viewing reports in TallyPrime.

You can now:

- Save a preferred view for a report with your desired configurations.

- Save a view for a report for a specific period.

- Save a view for a report opened for a particular master such as Party ledger, Stock Item, and others.

- Save views, as per your requirement, for:

- All companies on a particular computer

- A specific company

- Set a saved view as the default view.

Henceforth, the report will always open as per the configurations applied in the saved view. - Change the default view, whenever needed.

- Delete a saved view or all the views from all companies or a specific company, as needed.

- Restrict users from saving views for reports or deleting views saved in a specific company.

Saving your preferred views saves a great deal of time as you need not apply the configurations time and again.

Online GSTIN/UIN and HSN/SAC validation

TallyPrime is here with a quick and simple process to validate:

- GSTIN/UIN information for single and multiple Parties.

- HSN/SAC information for single and multiple Stock Items.

As a result, you get to know if the information entered in your books is authentic and update it, if needed.

TallyPrime Reports in browsers

Mobile-responsive design

The all-new mobile-responsive design provides you with an intuitive experience right from company selection to downloading a voucher.

Additionally, you can now enjoy the benefits of the following features:

Quick access to change date in Day Book

You can now view Day Book for the previous and next dates by tapping on the left and right arrow keys, respectively.

Scale Factor in selected reports

You can now apply Scale Factor in a report to view the values in hundreds, lakhs, and so on.

Introduction of Show Details

You can now view additional information in selected reports by tapping on Show Details.

Simpler way to change period

You now have a better experience in changing the period of reports in browsers.

File Name of Report downloaded from browser

The file name of the report downloaded from the browser will now have an underscore, which will separate the date and timestamp for easy identification of the date and time of the download.

e-Payments in TallyPrime

TallyPrime’s easy-to-use e-payment feature is now extended to RazorpayX Bank and Axis Bank.

Product Improvements – TallyPrime Release 2.0

File your GSTR-1 returns with HSN Summary as per the latest change

As per the latest amendments, in Table 12 of GSTR-1 (HSN Summary) the column Total Value is replaced with the column Rate of Tax. This release of TallyPrime enables you to file your returns with this change.

Party details in exported Ledger Group Outstandings

When you exported the Ledger Group Outstandings report to an MS Excel file, the details of some Parties were missing.

This issue is resolved.

Voucher Register with Verification Status

In the Voucher Register under Verification of Vouchers, the transactions did not appear for the selected Verification Status.

This issue is resolved.

e-Mailing Ledger and Group Outstandings

When you sent Ledger and Group Outstandings to parties via e-mail, the parties that did not have any outstanding amount received a blank report.

This issue is resolved.

GST calculation in sales transactions

When you recorded a sales transaction using Voucher Class, TallyPrime rounded off the tax value with three decimals to two decimals. Consequently, the calculated tax amount was lesser by 1 paisa.

This issue is resolved.

Terms of Delivery in Sales Invoice

Only the first line was visible in Terms of Delivery when you altered a Sales Invoice and provided the Order No.

This issue is resolved.

Performance enhancements in navigation

The performance enhancements in navigation will make your experience with TallyPrime all the more delightful. It will take fewer seconds to:

- Navigate to Credit Note voucher from Gateway of Tally

- Switch between Voucher Types

- Display the List of Ledgers

- Change Buyer Name

- Accept the Supplier Details screen

TCS transactions and reports

The TDL storage error appeared in the TCS transactions and reports, when Use TCS Allocations was enabled in the sales transaction.

This issue is resolved.

Error while uploading Delivery Note on the e-Way Bill system

An error appeared while uploading a Delivery Note on the e-Way Bill system. This happened when you had selected Others as Sub Type while recording the Delivery Note.

This issue is resolved.

Change of ledger in a columnar report

The report details were not getting refreshed when you changed the ledger in a columnar report.

This issue is resolved.

e-Way Bill Number in Multi-Voucher Printing

In multi-voucher printing, the last e-Way Bill number was printed in all the invoices.

This issue is fixed.

TCS Debit Note not linked to TCS Receipt voucher

TCS Debit Notes were not getting linked to TCS Receipt vouchers.

This issue is resolved.

TRN in Sales invoice printed in Arabic

The TRN did not appear when you printed a sales invoice in Arabic.

This issue is resolved.

e-Way Bill number in altered invoice

The e-Way Bill number did not appear in the print when the invoice was altered.

Click here for release notes

Click here for download

How to Download, Install and Activate TallyPrime

You can start using the TallyPrime features in a matter of minutes. All you need to do is download the setup file, install TallyPrime, and activate the license.

If you are a new user, create a company, and start recording your transactions. You can create all ledgers needed to maintain your accounts while recording transactions. In case you want to try TallyPrime before buying it, or you are a student, you can use the Educational version.

If you are using an earlier version of Tally, upgrade to TallyPrime, and continue your business as usual.

Download and Install TallyPrime

You can download the application setup from Tally Solutions website. After downloading the setup files, install the application on your computer. Installation steps remain the same regardless of the TallyPrime edition you have purchased.

You can install TallyPrime on any computer with 64-bit edition of Microsoft Windows 7 or later.

- Download the setup files.

- Go to https://tallysolutions.com/download/.

- Click Download.

- Select the folder where you want to save the setup.exe file.

- Click Save.

- Install TallyPrime.

- Double-click setup.exe.

- Double-click Install New.

- Configure Application Path, if needed.

By default, the application will be installed at C:\Program Files\TallyPrime.- Click Configure.

- Double-click Application Path.

- Click … and change the path as needed.

Note: If you are already using Tally.ERP 9, it is recommended that you install TallyPrime in a different folder. This will allow you to use both the products simultaneously, if needed.

- Close the List of Configurations window.

- Click Install.

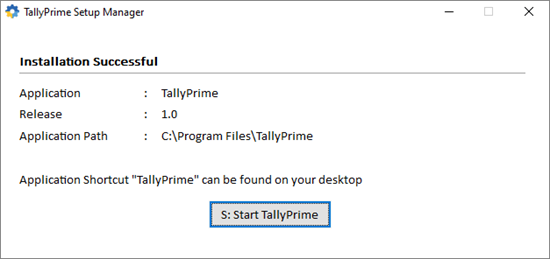

The application gets installed, and the following window opens.

- Click Start TallyPrime to launch TallyPrime.

You can activate the license and start using TallyPrime.

New Users – Activate License

If you have purchased a single user Silver License, you can activate the license on one computer. If you have a multiuser Gold License, you need to activate the license on one computer on the LAN, and configure all other installations using the same license.

Activate New License

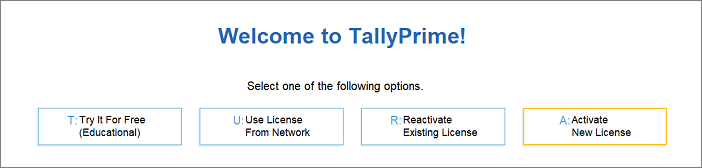

- Start your TallyPrime. The Welcome to TallyPrime screen appears.

- Click Activate New License.

- If you have a Single-Site license, enter your Serial Number, Activation Key, and Administrator e-mail ID.

Note: The e-mail ID provided here will be linked to your account, and used for all future communication and licensing activities.

- Press Enter to proceed. The Unlock License screen appears.

- Enter the Unlock Key sent to your e-mail ID.

Note: If you have not received the unlock key, press F2 (Get Unlock Key).

- Press Enter to unlock your license.

After your license is unlocked, the following message appears.

After activating the license, you can create your first Company and start using TallyPrime for business transactions.

Depending on the size and scale of your business, you can have different setups.

Try it for free | Educational version

If you want to try TallyPrime before you buy, or just want to learn how to use the product, you can use the Educational version for free. You can try all features in the product, just with the restriction that voucher dates are limited to 1, 2 and 31.

You can start using TallyPrime in Educational mode. The window title will be in dark green colour and will show EDU under the product name.

Try Tally.ERP 9 Accounting Software for Free

Try accounting software for free

Being a business owner, you got to do a lot of things to run your business. For you to completely focus on the things which matter the most for business growth, you need time to think and plan the business strategy. Today, one of the biggest mistakes, especially small business make is devoting most of their time in managing manual books of accounts. Somewhere in the process of managing manual books, businesses miss to catch the big fish. Here is why, accounting software’s are helpful and with no cost, you can try accounting software for free.

Today, we will discuss the benefits of free accounting software and How to download and try free accounting software.

Why try accounting software for free

No Doubt! Accounting software is invaluable for business. Not because it helps in ease of managing books of account, but the business information provided by accounting software is precious for decision making. The following are the business benefits of trying the best accounting software for free.

- Ease of accounting and managing Books.

- Printing professional-looking invoices in few seconds

- Better control and clean track of bills receivable and payables.

- Business information at your fingertip since the reports are auto-generated

- Books are accurate and always complete

- Ease of managing tax Compliance

- Accurate returns in the prescribed format

- Optimum inventory and stock level

- Better control on cash flow and much more…

How Tally.ERP 9 can help you?

You work hard to grow your business. You need software which grows with you. Tally.ERP 9, is the an accounting software used by more than 17 Lakhs business. The following are the features of Tally.ERP 9:

- Professional invoicing with multiple billing format

- Effective cash and credit Management

- Flexible order management

- Accurate and flexible inventory management

- Seamless e-banking capabilities and banking utilities

- Insightful business reports at blink of an eye

- Managing tax compliance is a cakewalk

- Payroll accounting & salary processing

- Enhanced security and user Management

- Cost control and cost analysis

- Secured remote access and data synchronization

How to download free accounting software

The free version of accounting software can be download from the official website of Tally. To download the free accounting software, you need to visit https://tallysolutions.com and navigate to the download page. The following are the steps to download free accounting software.

- Visit https://tallysolutions.com

- Click on the ‘Download’ option available on the top right side of the menu

- In the middle of the download page, click on ‘Download Now’

- Once the download is complete, you are ready to install the free version of accounting software – Tally.ERP.

Downloading the best accounting software is free and you need not sign up for downloading it.

How to try accounting software for free

To try accounting software for free, you need to download the accounting software from the website mentioned in the above section. Downloading accounting software is free. Once you download the accounting software, you must install it in educational mode. The educational mode allows you to learn and use Tally.ERP 9 without buying a license. Explore and experience the best accounting software for free on your computer. Visit Tally Solutions website for more details and sign up for a free trial.

Tally.ERP 9 Release 6.6

Highlights

The latest release brings to you a simple, secure, and swift way to view Tally.ERP 9 reports on the go using any device. Login to Tally portal in a web browser and get frequently used business reports from Tally.ERP 9 on demand.

This release also provides:

- For India: GST reports for Jammu & Kashmir and Ladakh – You can now generate GSTR-1, GSTR-3B, GST CMP-08, and GST Annual Computation to help file GST returns for the periods before and after 1-Jan-2020.

- For UAE: New Invoice Format 2 to allow you to print VAT invoices (in English) as required by FTA.

Product Improvements

- In the Export for e-Way Bill report, the exported e-Way Bills appeared under Invoice Ready for Export section. This issue is resolved. Now the exported e-Way Bills are appearing under Invoices Exported section.

- Provision to record transfer of Input Tax Credit from SGST to UTGST is now supported for Ladakh.

- The message that appeared in the calculator panel while navigating to the ledger display screen (Gateway of Tally > Accounts Info. > Ledger >Display > select any ledger) is now taken care of.

- Total Invoice Value appearing in GST Returns when transaction was booked in accounting voucher mode has been corrected.

- The crash which occurred in a particular case of opening or saving an accounting voucher is resolved.

Click here for release notes

Click here for download

How to download, install and activate Tally.ERP 9

Use Your Tally.ERP 9 Company from Anywhere

When your business needs the flexibility to access your data from anywhere, you can use the remote capabilities of Tally.ERP 9 for the same. Tally.ERP 9 provides support for accessing your company data using in-built Remote Access feature and Browser Access feature. In your office you need to have a valid Tally.ERP 9 license, an active TSS, an internet connection, and your company connected to Tally.NET services. You can also use Tally.ERP 9 on the computer in your office using third-party remote desktop (RDP) tools.

With the remote access capability, you can have your business data at your fingertips, even when you are attending a business meeting or out on a trip. If you or your employees want to work from home, or access the company data from the client location, Tally.ERP 9 remote capabilities come in handy.

Security and Control : You have complete control on who can access your company, and which features are available to the user. Further, your data will always be in your computer. Whenever a user connects to your company, based on the access permissions you have provided, the user can access the required features.

Audit Accounts : You can also allow your auditor to do verification of your books, if needed. If you are a Chartered Accountant, you can use your Tally.NET ID to get access to your clients’ data by making them give you access to their companies.

You can avail any of the following features based on your needs.

â— Remote Access – to record or alter your transactions, view reports, and print vouchers or reports.

â— Browser Access – to view or print reports and vouchers from any device.

â—Â Use RDP to access your computer where Tally.ERP 9 is installed, and work. To access your computer using RDP, you need to use third-party tools like Microsoft RDP, Citrix, VPN, TeamViewer, and so on.

You may use Tally.ERP 9 in Educational Mode or through a Rental License .

Tally.ERP 9 Release 6.4.7

The latest version under Tally.ERP 9 Release 6 series is Release 6.4.7, launched on 2nd August, 2018.

Below are the key enhancements of Tally.ERP 9 Release 6.4.7:

Enhanced GSTIN validation

Earlier for few taxpayer types, GSTIN validation was failing in Tally.ERP 9. Now, with this new Release, GSTIN will get validated for all taxpayer types

Option to avail Input Credit under Reverse Charge in current or future periodÂ

- If your business needs to avail input credit using reverse charge mechanism, you will find it delightfully useful and flexible to take credit on reverse charges in current or future periods

- If you wish to keep track of total liability towards reverse charges or input credit availed, you can easily do so now with the new report, “Input Credit to be booked”

Highlights of Tally.ERP 9 Release 6 series.

Record Fixed Asset purchases in account invoice modeÂ

For your convenience, you can now record Fixed Assets purchases in account invoice mode as well. This was earlier possible only in the voucher mode.

- Enter e-Way Bill Number (EBN) in its corresponding invoice, print the invoice and hand it over to the transporter.

- You can export JSON file for a single invoice or for multiple invoices together in one go.

- If the mode of transport, vehicle no., place of supply and State are same for a given set of invoices, you can group invoices accordingly and generate a single JSON file for a consolidated e-Way Bill. But first, you must generate e-Way Bills for each invoice as a prerequisite.

- Tally.ERP 9 identifies invoices for which e-Way Bills are yet to be generated. You can add, modify, delete, consolidate and track e-Way Bills against invoices.Tally.ERP9 also shows which details are missing in the invoice for the purpose of generating e-Way Bills.

- You can generate e-Way Bills on behalf of your supplier or transporter; or in cases of purchases and also for credit notes, delivery notes and receipt notes as well.

Click here for release notes

Click here for download

Liability to Pay GST which is unpaid – For Stakeholders

Liability to pay GST – For Agent and Principal

If an agent supplies or receives any taxable goods on behalf of his principal, then both the agent and the principal will be liable to pay unpaid GST, jointly and severally. This defines the liability to pay GST for both agents and principal.

Liability of Directors of Private Company

If a private company does not pay its dues, then the directors of the company will become jointly and severally liable for the dues, i.e. there will be some personal liability for directors. In this case, only the directors who were in office during the period when the tax was due, will have the liability to pay GST. However, if a director can prove to the tax commissioner that the non-payment was not due to any negligence or breach of duty due to his part, then he will not be held liable.

Note: Nothing has been specified as such in the GST Act with regards to conversion or transfer of a private company to a public company. However, a rule in this section states, that this provision does not apply when a private company is converted to a public company. Thus, it can be interpreted to mean that this provision does not apply to public limited companies.

Liability of Partners of a Partnership Firm

In a partnership firm, all the partners have unlimited liability. Similarly under GST, the partners of the firm are jointly and severally liable to pay unpaid GST which is due irrespective of any clause in the partnership deed or any other law.

In case of retirement of a partner, the commissioner must be informed of the same by the firm or the retiring partner. This is because, it could be possible that the retiring partner could have the liability to pay GST until the date of his retirement. If any intimation regarding the retirement is not given within 1 month, the retiring partner will continue to face liabilty for unpaid GST, till such an intimation is received by the commissioner.

Liability of Guardians, Trustees, Agents

Liability to pay GST comes into play when any business is conducted by a guardian or trustee or agent on behalf of and for the benefit of a minor or an incapacitated person. In case of any tax amount due, both the guardians or trustees or agents and the beneficiary will be liable to pay under the GST Act, and the due amount may be recovered from both parties. Thus, it is important to understand GST liability of guardians, GST liability of trustees and GST liability of agents, for such scenarios.

Liability of Court of Wards

This scenario is applicable, when the estate of a taxable person owning a business, is under the control of the Court of Wards or the Administrator General or the Official Trustee or any receiver or manager appointed by a court. In such a case, if the business owes any amount under GST, then all entities will be equally held liable, i.e. the Court of Wards, the Administrator General, the Official trustee, any receiver or manager along with the taxable person.

How Tally.ERP 9 Simplifies Generating E-Way Bills for you?

You might have already generated e-Way Bills for your business since e-Way Bills are mandatory for interstate movement of goods in India from April 1st onwards.

An e-Way Bill has to be generated if the total of taxable value and tax amount in the invoice of goods being transported exceeds Rs. 50,000, and in few States for intrastate transactions as well.

By now, you must also be aware of the challenges involved in generating e-Way Bills. It is quite likely that you are evaluating a software to make it easy for you to generate and manage e-Way Bills, or you are already using Tally.ERP 9 to do so.

In this blogpost, we will take you through the various challenges that businesses go through on a typical day and how Tally.ERP 9 supports them by helping generate e-Way Bills in a faster and simplified way. Tally.ERP 9 Release 6.4 has been launched with the purpose to make e-Way Bill generation and management easy for you.

Generating e-Way Bills faster using Tally.ERP 9

For many businesses, generating e-Way Bills is now mandatory in addition to their routine activities. Businesses need to generate e-Way Bills faster and correctly for overall efficiency.

Businesses such as distributors of machinery, electrical equipment, consumer durables, wholesalers and manufacturers who dispatch goods in bulk will find it handy to generate an e-Way Bill right at the time of creating the invoice.

Keeping this in view, at the time of creating the invoice after you have provided all the invoice level details, Tally.ERP 9 opens an additional form where you can provide transportation and other details required for generating e-Way Bill.

On the other hand, a business involved in dispatching small quantities of goods such as FMCG distributors will find it a hindrance to generate e-Way Bills for every transaction. They will prefer to generate e-Way Bills in bulk since they dispatch goods for multiple orders at the same time.

In such a case, you can disable the e-Way Bill form in Tally.ERP 9 when creating sales invoices. When you are ready to dispatch goods, you can see all the transactions for which e-Way Bills are yet to be generated. You can select them all together and export them as a single JSON file which can be uploaded on the e-Way Bill portal. The portal will generate e-Way Bills for all these invoices in a single click.

How Tally.ERP 9 helps generate e-Way bills correctly?

Errors can take place when entering data. Tally.ERP 9 has inbuilt capability to check for such errors.

In the absence of any mandatory detail such as distance, vehicle number, pin codes of consignee and consignor, and so on, Tally.ERP 9 will not allow you to export the JSON file for the purpose of generating e-Way Bill. It also checks if the GSTIN numbers and Transporter IDs of the parties are correct or not.

Due to all these inbuilt checks, the chances of your JSON file getting rejected in the e-Way Bill portal is minimized. Generation of e-Way Bills will be faster and accurate.

Be sure to not to miss e-Way bills

Typically, businesses are involved in multiple things at the same time. In a hurry, you could send the goods to your transporter without an e-Way Bill. Due to this, your consignment can get delayed and you will miss out on your promise made to customer. This situation can be avoided easily. Tally.ERP 9 ensures that all the transactions for which e-Way Bills are yet to be generated are available in one place in a single report. You will never miss generating the required e-Way Bills. Even if you have created an e-Way Bill in the portal first, you can update the respective transaction with e-Way Bill details at a later stage through this report.

How Tally.ERP 9 helps in generating consolidated e-Way bill?

If the State, place of supply, vehicle no. and mode of transport are the same, then you can group such invoices, generate their individual e-Way Bills and finally consolidate the individual e-Way Bills and generate a single consolidated e-Way Bill.

Tally.ERP 9 helps you in grouping invoices based on the above criteria, with a single click. This makes it convenient for the transporter since he can now carry just the single consolidated e-Way Bill for multiple invoices.

We have taken you through various kinds of business scenarios with respect to e-Way Bills and explained how Tally.ERP 9 handles all of them, simplifying the generation of e-Way Bills. We are eager to hear about your experiences. Download Tally.ERP 9 Release 6.4 and let e-Way Bill management make your business more efficient. Do share your experience with us.