Experience the freedom of viewing your Tally.ERP 9 reports from anywhere, on any device, in a browser, securely. All you need is Tally.ERP 9 Release 6.6, and a device with a web browser and internet connection.

Anywhere, Any device : You can access Tally.ERP 9 reports from anywhere using any device such as, laptop, smartphone, tablet, and so on, with a web browser, and an active internet connection.

Security and Control : You have complete control on who views the reports, and which reports are available to a user. Further, your data will always be in your machine. Whenever a user views a report in a browser, only the data required for that report is fetched from your Tally.ERP 9.

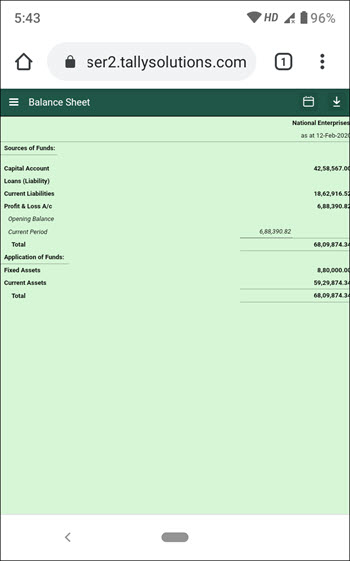

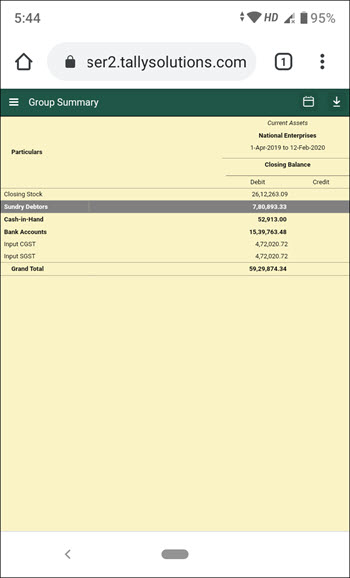

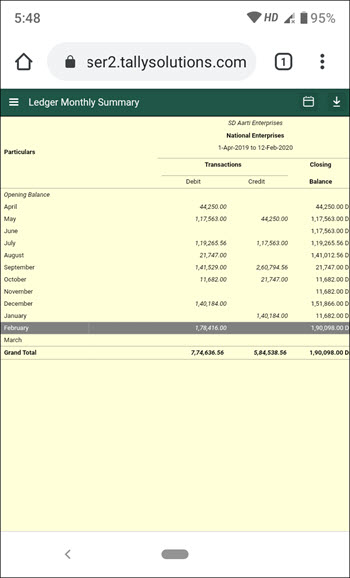

Reports in a web browser : Select the company, then select the report from the list shown once you log in to the Tally portal. The report with the latest data is fetched and displayed. You can drill down to the next levels of the report to get further details. You can change the period of the report as well. Refresh the page to get the updated information.

Download Reports and Invoices : You can open a report and download it as a PDF document. You can drill down up to the voucher level. You can also download invoices and vouchers.

Easy Setup : Update to Tally.ERP 9 Release 6.6, connect your company, and allow users to view reports from anywhere. Note that only users with valid Tally.NET IDs are allowed to view reports in browser. Your account ID (e-mail ID used to activate your license) is a valid Tally.NET ID. You can also create Tally.NET IDs for users who need to view reports in browser.

Connect Company to view reports in browser

You can decide when to connect your company for users to view reports and disconnect the same when it is not needed. You need to have internet connection on the computer where Tally.ERP 9 is installed.

1. Go to Gateway of Tally , click F4: Connect .

a. If you have enabled security control for your company, move to step 2.

In case you have not enabled security control for your company, Tally.ERP 9 will prompt you for the same.

o In the Security Control screen, the option Use security control is set to Yes .

o Provide the administrator details. This login credential is for the company data.

2. Provide report access to Tally.NET users.

a. Click Yes to add Tally.NET users and allow browser access.

b. Select the Security Level as Tally.NET Owner .

c. In Username/Tally.NET ID , enter a valid Tally.NET ID for which you want to give access.

Note: You can check for valid Tally.NET IDs on the Tally portal , by logging in with account administrator’s e-mail ID. You can also create more Tally.NET IDs, if needed.

Now that the company is connected, a sign (c) appears against the company name in the List of Selected Companies in the Gateway of Tally.

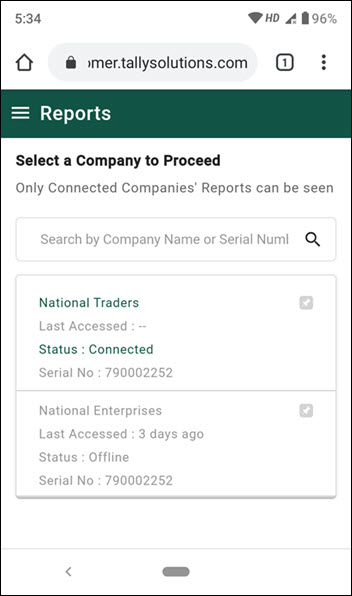

When an authorised user logs in to the Tally portal, the connected company appears in the List of Companies with the status as Connected .

View Tally.ERP 9 reports from anywhere using browser

1. Open www.tallysolutions.com and log in using your Tally.NET ID and password. All the companies that you can access are listed with the status as Connected or Offline .

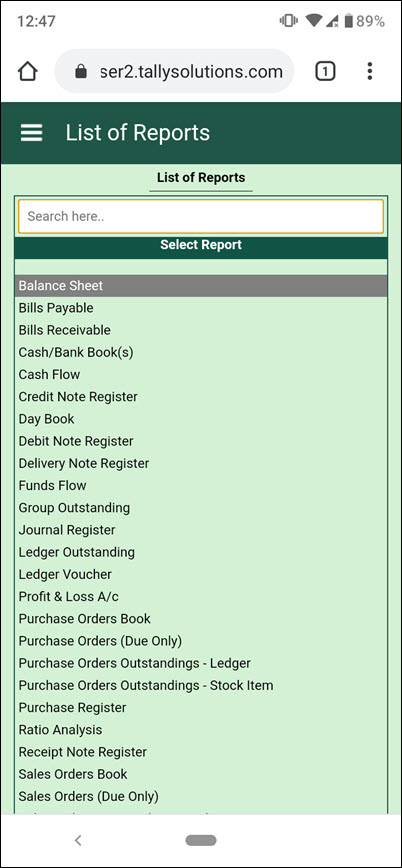

2. Select a connected company. The List of Reports is displayed.

3. Select the report that you want to view. A request is sent to Tally.ERP 9, and the selected report is fetched to display in the browser. You can download the report as a PDF document by clicking ![]()  , and change the report period by clickingÂ

, and change the report period by clicking ![]()  on the top-right corner of the screen.

on the top-right corner of the screen.

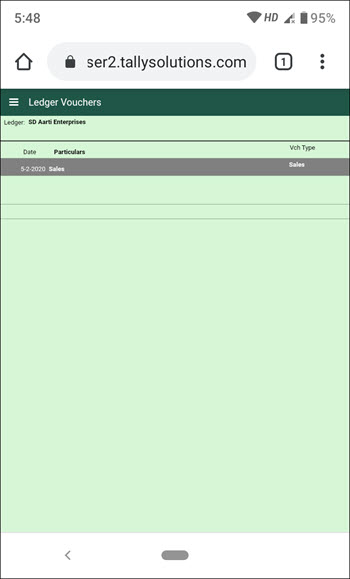

4. To get further details of any value, you can drill down up to the voucher level in many reports. You can also download the voucher as a PDF document.

Â

Use the Back button of the browser to go back to the previous screen. In case you are accessing from a phone, the phone back button does the same.

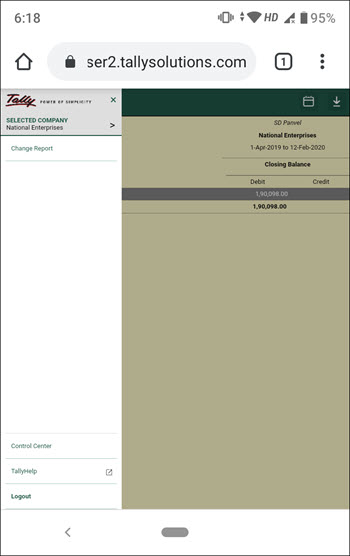

5. To change the report, you can use ![]()  on the top left of the screen, and click Change Report .

on the top left of the screen, and click Change Report .

6. To change company, you can use ![]()  on the top left of the screen, to view the List of Companies, and click SELECTED COMPANY .

on the top left of the screen, to view the List of Companies, and click SELECTED COMPANY .

Manage Access Rights of Users

You can add many Tally.NET users, and allow them to view reports in browser. You can also decide who can access which report.

In this section

â—Â Create Tally.NET IDs

â—Â Allow users to view reports in browser

â—Â Create Security Levels to provide limited access to reports

Create Tally.NET IDs

You can create Tally.NET IDs directly on the Tally portal. Alternatively, you can create using Control Centre in Tally.ERP 9.

1. Go to Tally portal , log in using your account administrator’s e-mail ID.

2. On the left pane, click Control Centre > User Management > Manage Users .

3. In the Manage Users screen, click CREATE USER .

4. In the Create New User section, select the required Security Level as Standard User or Owner .

5. In the Tally.NET ID field, enter a valid e-mail ID. The password for the Tally.NET ID is sent to the email ID provided.

6. Select the option Enable Tally.NET Services to give access to Tally.NET features and browser reports.

7. In case you have multiple branches, select the branch for which the user is allowed to access reports in browser.

8. Click CREATE .

Tally.NET IDs are created. You need to allow browser access to these users, in Tally.ERP 9, so that they can view reports in browsers.

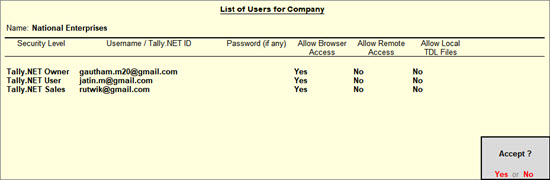

Allow users to view reports in browser

You can allow many users to view reports in browser.

1. Go to Gateway of Tally > F3 : Cmp Info > Security Control > Users and Passwords .

2. Select the Security Level as Tally.NET Owner , Tally.NET User , or Tally.NET Auditor . You can also create Security Levels, if needed.

3. In Username/Tally.NET ID , enter the required Tally.NET ID.

4. Set the option Allow Browser Access to Yes , and accept.

Note: By default, the security level Tally.NET Owner and Tally.NET Auditor provide access to view all the reports available for viewing in browsers. But the security level Tally.NET User has access to only a few reports. The reports that are not available to the security level Tally.NET User are given here .

â— In case you need to disallow viewing reports for this company in browsers for a user, set Allow Browser Access to No .

These users can view reports in browsers, whenever the companies are connected.

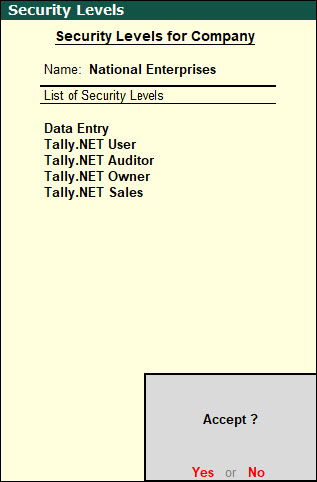

Create Security Levels to provide limited access to reports

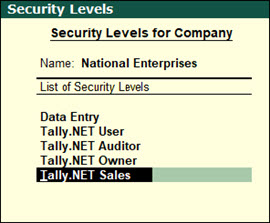

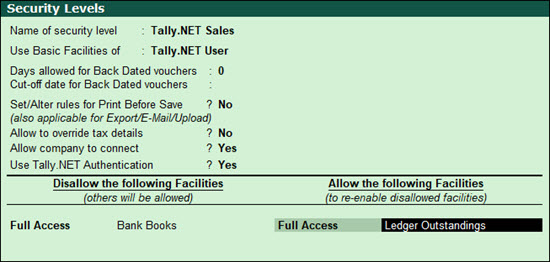

You can create multiple Security Levels to manage user access to different reports in Tally.ERP 9. If Tally.NET IDs are added under such Security Levels, you can control who can view which report in browser.

1. Go to Gateway of Tally > F3 : Cmp Info > Security Control .

2. Select Types of Security and press Enter .

3. In the Security Levels screen, move to the end of the entries in List of Security Levels to get a blank row.

4. Enter the name for the new security level and press Enter to drill down.

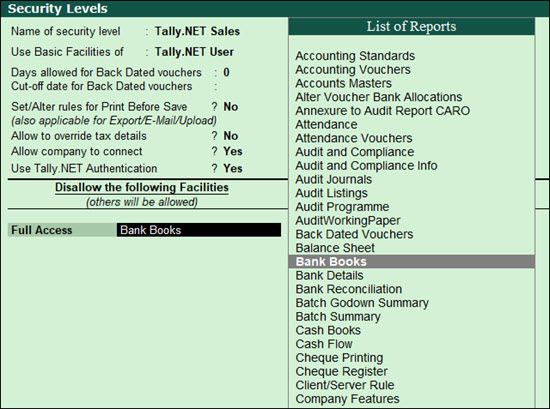

5. In the Use Basic Facilities of field, select Tally.NET User .

6. Ensure that the option Use Tally.NET Authentication is set to Yes . This will enable you to change the configuration of Allow Browser Access option while adding a user.

7. In the Disallow the following Facilities column, select Full Access from the Type of Access list and press Enter .

8. Select the name of the report you want to disallow. For example, if you want to disallow access to Bank Books , select it and press Enter . Full access to Bank Books is disallowed for this security level and for all users added under this security level.

9. In the Allow the following Facilities column, select Full Access from the Type of Access list and press Enter .

10. Select the name of the reports you want to allow access. For example, if you want to allow access to Ledger Outstanding , then select it and press Enter .

11. Similarly, allow access to other reports, Group Outstandings and save.

You have created a new security level with access to all reports available for a Tally.NET User except Bank Books and additionally allowed access to Ledger Outstandings and Group Outstandings .

12. Add Tally.NET IDs under this Security Level to allow these users to view the limited set of reports in browser.

Manage Company for Browser Access

You have complete control and flexibility on the company setting for report access, including when the access is needed.

â—Â Enable/Disable browser access for your Company

â—Â Disconnect Company

â—Â Connect/Disconnect multiple companies

â—Â Connectivity Status report in Tally.ERP 9

â—Â Remove names of Offline Companies not used from the list in browser

Enable/Disable browser access for your Company

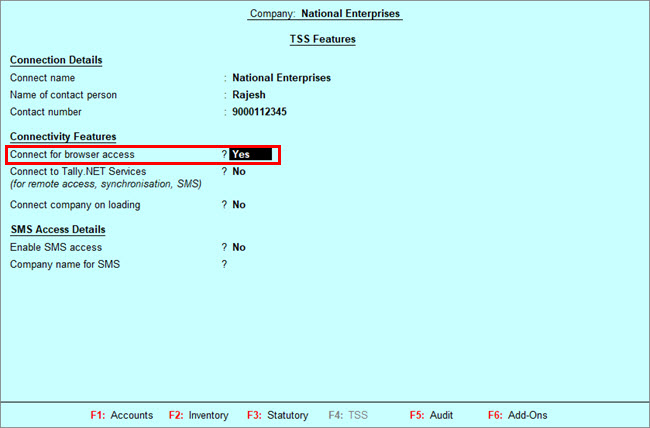

When you update your Tally.ERP 9 to Release 6.6, browser access is enabled for the company. However, you can disable it when no users are expected to view the reports.

â— Go to F11: Features > F4: TSS Features to check your settings. You will see that Connect for browser access is set to Yes .

â— If you need to disable browser access, set the option to No .

Disconnect Company

When there is no need for users to access reports in browser you can disconnect the company.

â— Click F4: Disconnect .

When you disconnect a company in Tally.ERP 9, the status of the company changes to offline on the Tally portal.

Connect/Disconnect multiple companies

When you have more than one company open in Tally.ERP 9, you can connect any or all of these companies at once. Ensure that the companies have security enabled and Tally.NET IDs are added to give access to reports in browser before using multiple company connect functionality. You need to have internet connection on the computer where Tally.ERP 9 is installed.

1. Open all the required companies.

![]()

2. Click F4: Connect .

![]()

3. In the Connect Companies screen, select the companies one by one.

![]()

4. Press Enter to connect. You can see the connection success message for each company in the calculator panel.

When multiple companies are connected, you can disconnect many connected companies at once.

â— Press Alt+F4 to disconnect the companies.

â— In the Disconnect Companies screen, select the companies to disconnect and accept.

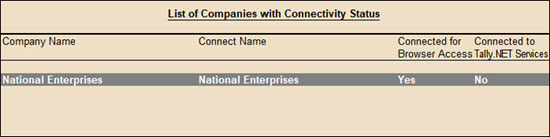

Connectivity Status report in Tally.ERP 9

This report gives you details of all the companies connected for Browser Access and Tally.NET Services. This report is active when at least one company is connected.

1. Go to Gateway of Tally > F3 : Cmp Info .

2. Select Connectivity Status .

The Connectivity Status report displays the company name, the company’s connect name, and the status of connection for Browser Access and Tally.NET Services.

Remove names of Offline Companies not used from the list in Browser

When a company is connected for browser access the name of company continues to be shown in the browser list for ever. In case you are not connecting that company anymore the name will continue to appear but with connection status as offline. You would want to remove all such names from the list of companies in the browser which are no more connected and only appear as offline. You can do so using the Remove from the list option.

1. Open www.tallysolutions.com and log in using your Tally.NET ID and password. All the companies that you can access are listed with the status as Connected or Offline .

2. Click the three dots provided next to the offline company.

3. Click the option REMOVE FROM THE LIST .

4. A message Are you sure you want to remove the company from the list? to confirm . click Remove .

5. A confirmation message is displayed once the company is removed successfully. click Ok .