Data Management in Tally

Auto Backup in Tally.ERP 9

Split Company Data

Splitting Company Data after finalization of accounts.

Introduction

Tally’s flexible period-less accounting permits the entry of data for any number of years. This feature has tremendous benefits. The presence of voluminous old data creates unnecessary load on the system.

Splitting a financial year enables you to retain most of the benefits while overcoming this system overhead.

When you split the data, two things happen:-

1. New companies are created for the respective split periods.

2. The entire data is retained in the original company.

How to Split Company Data :

I. For Tally.ERP 9 Release 2.1 and Lower Releases (including Tally 9)

Pre-split activities

Before you split the data, ensure that:

- All adjustment forex gains/losses have been fully adjusted using Journal entries. Verify that the item “Unadjusted Forex Gains/Loss” does not appear in the balance sheet

- There are no pending purchase bills/sales bills. Check the profit and loss account and inventory statements for pending purchase/sales bills. You may account them to the respective party accounts or to the respective “bills pending†accounts.

- Ensure that all the Bank Vouchers are reconciled from Bank Reconciliation statement.

- Ensure that a Backup of the data has been taken

Procedure to Split the Financial Years

- Go to Gateway of Tally, Select Alt+F3: Cmp Info.

- Select Split Company Data.

- Select the Company whose data is to be split.

- Tally recommends the split from date based on the existing data. It is recommended that the Split Point is set as the beginning of the latest financial year, though Tally permits any date as the split point.

- Splits occur in sets of two periods. Hence, start with the latest. For example, you need to split a company’s four years data (1-4-2008 to 31-03-2012) into four separate “companiesâ€, each with a particular financial year. Select the beginning of the latest financial year first (1-04-2011).

- On confirming the periods, two new companies will be created – one with data from 1-4-2008 to 31-03-2011, i.e., for three years, and the other for the period 1-4-2011 to 31-03-2012.

The historical data, for one or more financial years, will be preserved as a single company, and the current financial year, will be preserved as another company. Normally there is no reason or benefit to split the earlier years again into separate companies. If you wish to do so, repeat the steps mentioned above for the earlier period (1-4-2008 to 31-03-2009, 1-4-2009 to 31-03-2010 & 1-4-2010 to 31-3-2011).

All the companies are full companies in their own right. Data can be entered, displayed and altered. Please print the key financial reports (Trial Balance, Balance Sheet, Profit & Loss, and Stock Summary etc.) for each company for the relevant periods and compare them for accuracy.

Once you are satisfied that you have a successful split, it is advisable to take a backup of the original company and permanently delete its data from the hard-disk. This will prevent any accidental entry of fresh data into the old database.

To delete a company, press Alt+F3 at the Gateway of Tally, select a company to Alter it, and at the point where you can modify the Company Information, press Alt+D.

You will also need to alter the names of the two freshly created companies as per your requirement.

II. For Tally.ERP 9 Release 3.0 and Above

Pre-split activities

Before you split the data, ensure that:

- Verify Company Data Utility: Verify Company Data is a built-in utility which detects the possible error that occurs on data verification and provides the respective reason for the error detected. Further, it prompts the user to rectify the listed error with possible solution so that the same errors do not reoccur in future. The user has a choice to resolve these errors manually or by using the helper available.

- All adjustment forex gains/losses have been fully adjusted using Journal entries. Verify that the item “Unadjusted Forex Gains/Loss” does not appear in the balance sheet

- There are no pending purchase bills/sales bills. Check the profit and loss account and inventory statements for pending purchase/sales bills. You may account them to the respective party accounts or to the respective “bills pending” accounts.

- Ensure that a Backup of the data has been taken

Verify Company Data

To start the data verification process before splitting the data:

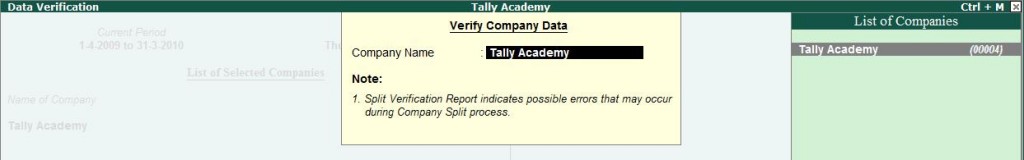

- Go to Gateway of Tally > F3: Cmp Info. > Split Company Data > Verify Company Data

- Select the required company

- Press enter to view the Possible Errors screen.

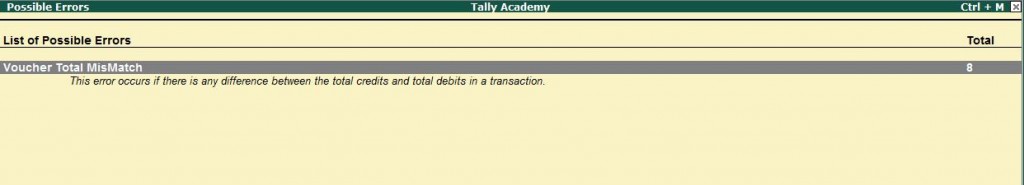

The Possible Errors screen is displayed as shown

Possible Error screen display the Errors, Reason for the Error

Procedure to Split the Financial Years

- Go to Gateway of Tally, Select Alt+F3: Cmp Info.

- Select Split Company Data.

- Select the Company whose data is to be split.

- Tally recommends the split-off date based on the existing data. It is recommended that the Split Point is set as the beginning of the latest financial year, though Tally permits any date as the split point.

- Splits occur in sets of two periods. Hence, start with the latest. For example, you need to split a company’s four years data (1-4-2009 to 31-03-2012) into four separate “companies”, each with a particular financial year. Select the beginning of the latest financial year first (1-04-2011).

- On confirming the periods, two new companies will be created – one with data from 1-4-2008 to 31-03-2011, i.e., for three years, and the other for the period 1-4-2011 to 31-03-2012.

The Split Company Data screen displays as shown:

The historical data, for one or more financial years, will be preserved as a single company, and the current financial year, will be preserved as another company. Normally there is no reason or benefit to split the earlier years again into separate companies. If you wish to do so, repeat the steps mentioned above for the earlier period (1-4-2008 to 31-03-2009, 1-4-2009 to 31-3-2010 & 1-4-2010 to 31-03-2011).

All the companies are full companies in their own right. Data can be entered, displayed and altered. Please print the key financial reports (Trial Balance, Balance Sheet, Profit & Loss, and Stock Summary etc.) for each company for the relevant periods and compare them for accuracy.

Once you are satisfied that you have a successful split, it is advisable to take a backup of the original company and permanently delete its data from the hard-disk. This will prevent any accidental entry of fresh data into the old database.

To delete a company, press Alt+F3 at the Gateway of Tally, select a company to Alter it, and at the point where you can modify the Company Information, press Alt+D.

You will also need to alter the names of the two freshly created companies as per your requirement.

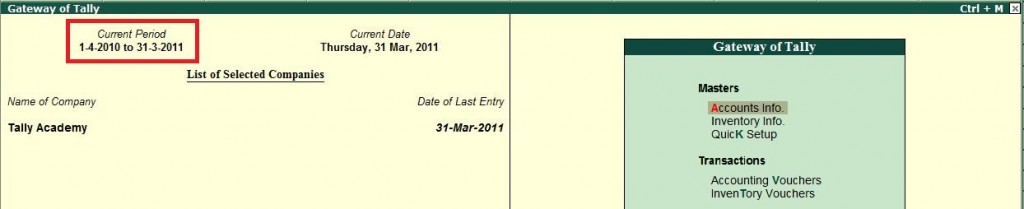

How to change current period in Gateway of Tally

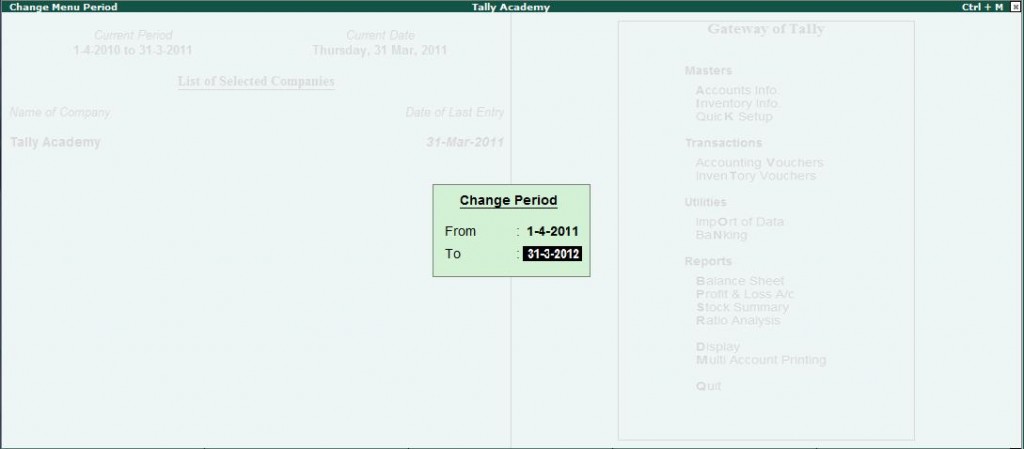

The Current Financial Year is 1-4-2010 to 31-03-2011, and in the Gateway of Tally it displays the Current Period as shown:

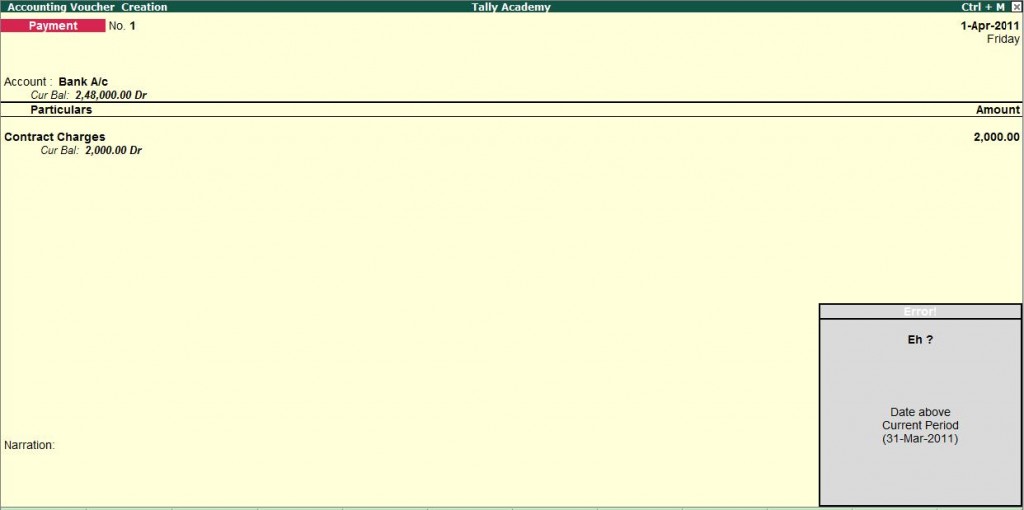

Now if you want to create a voucher on 1-4-2011, the error message Date above current period (31-Mar-11) is displayed.

Now if you want to create a voucher on 1-4-2011, the error message Date above current period (31- Mar-11) is displayed.

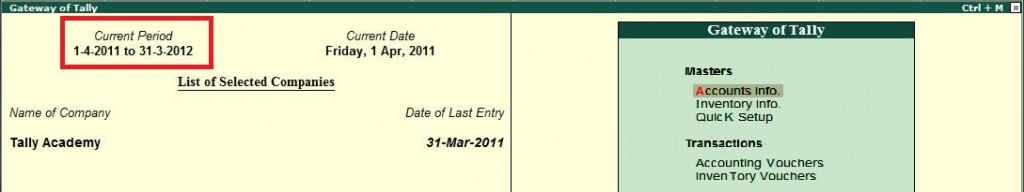

Change the Current Period in the Gateway of Tally by pressing Alt + F2 Change Period 01-04-2011 to31-03-2012, and then record the vouchers for the new financial year.

It will change the Current Period information and you will be able to save vouchers for the financial year

2011-12.

Balances of the previous financial period will be carried forward without passing any closing transactions.

Simple Reorder Level and Minimum Quantity in Tally ERP 9

The Reorder and Minimum order quantity is defined based on fixed consumption pattern.

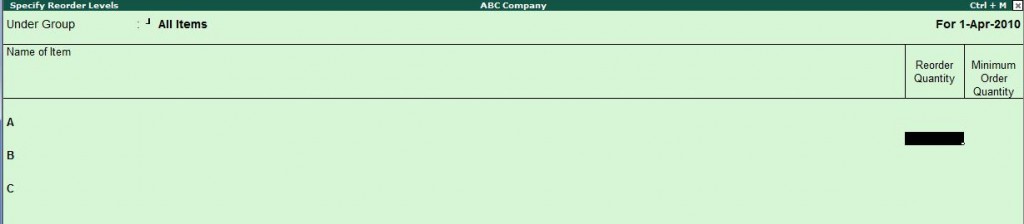

When you select the Stock Group under the Reorder Levels menu, the Simple Reorder Levels screen will be available, by default.

Go to Gateway of Tally > Inventory Info. > Reorder Levels

Select a group of Stock Items from the List of Groups, to specify Reorder Levels for the Stock Items in the Specify Reorder Levels screen. For each item in stock, you can define a Reorder Level and the Minimum Order Quantity.

The Simple Reorder Levels screen appears as follows:

Reorder Quantity

Enter the level/quantity in the Reorder quantity field.

Minimum Order quantity

Specify the minimum order quantity required based on economical order lot predetermined.

In Simple Reorder Levels screen, the consumption alternatives will not be available and hence you have to input the only the quantities. i.e., the options that you have in the above mode are to define Reorder Quantity and Minimum Order Quantity.

If you have used Advanced Reorder options earlier, click Simple Reorder button, to specify simple reorder levels.

The options available in the Reorder Levels screen are as follows :

R : Adv Reorder

Press Alt+R to toggle to Advanced Reorder Levels screen.

M : Adv Min Qty

Press Alt+M to toggle to Advanced Minimum Order Quantity screen

Inter–state Sales Invoice in Tally ERP 9

Interstate Sales Against Form C

Go to Gateway of Tally > Accounting Vouchers > F8: Sales

- Select As Invoice

- Enter the reference in the Ref. field, if required

- Select the Party’s A/c Name from the List of Ledger Accounts

- Select the Sales Ledger with the VAT/Tax class – Â Interstate Sales @ 2% Against Form C.

- On selecting the Sales Ledger, the VAT/Tax Class appears accordingly. In case the VAT/Tax Class is not defined in the master, select Interstate Sales @ 2% Against Form C from the VAT/Tax Class list.

- Select the Name of Item from the List of Items.

- Enter the Quantity and Rate. The amount is automatically displayed in the Amount field.

- Select the CST ledger grouped under Duties & Taxes with Type of Duty/Tax as CST and VAT/Tax Class – CST @ 2% from the List of Ledger Accounts. The amount of CST is automatically calculated on the assessable value.

- Select Form C as Form to Receive, if applicable.

- The Form number and Date fields will be displayed on selecting the Form to Receive from the Form Types list.

- Enter the Form number and Date if available for the Form selected

- Set Show Statutory Details field to No

- Enter Narration if required

- Press Enter to accept and save.

Tally License Unlock Key

| Note: |

| This service is provided to assist you in completing the License Activation. Use this option when there is delay in receiving email containing the “License Unlock Key”. |

| 1. This service is enabled Only after 9 minutes of activation for the respective serial number. |

| 2. The Unlock key is available for the last Activation request only. |

| This service is provided so that you can start working with the product when there is a delay in receiving the email. However, the email is required as it contains the ‘License Unlock Key’ and Tally.NET user login credentials. Your Tally.NET ID is essential for any further Licensing operations and also to access various Tally.NET Services.

Please Click here to get Unlock Key |

Tally.ERP 9, Series A, Release 1.6, Build 258 27th January 2010

The highlights of this release are listed below. See the complete release notes here.

In Tally.ERP 9

Data Synchronisation

Quick Setup (Wizard)

Stock Query

Mass Emailing

Batch Vouchers Report

Multi Page Excise Invoice Printing

In Tally.ERP 9 – Auditors’ Edition

Statutory Audit

Schedule VI

Data Analysis

Quick Setup (Wizard)

Auditing

Please click here for more details

Available new stat 98 from 21st January, 2010

New Stat.900 Version is available free for existing Tally User

Major Enhancemnet are :

Value Added Tax :

Chandigarh : The Form VAT 20 has been provided as per the statutory requirements.

Maharashtra : The Audit Form 704 is provided as per the statutory requirement for filing of e-returns.

Issues Resolved :

Tax Deducted at Source : Details of TDS transactions recorded by selecting the Nature of Payment – Winnings From Lotteries and Crossword Puzzles (Sec 194B) are not being captured in the exported etds

text file.

For more details please click here

For Download the Stat 98 Please Click here

Leave a Comment

Comprehensive Financial Statements as per Schedule VI

Using Auditors’ Edition of Tally.ERP 9 the following Financial Statements can be prepared as per the Schedule VI requirements as specified in Companies Act:

• Balance Sheet as per Schedule VI

• Profit & Loss A/c as per Schedule VI

Some of the salient features of Schedule VI Balance Sheet are:

• Can be generated with a single click

• Tally Default Groups (Business Groups) are mapped to Schedule VI groupings by default.

• Can be further regrouped as required (User defined)

• Flexible Schedule numbering

• Generation of Schedules

• Export to Excel for further formatting if required.

Some of the salient features of Schedule VI Profit & Loss A/c are:

• Sales & Income Groups are mapped to INCOME by default

• Expenses & Purchase Groups are mapped to EXPENDITURE

• Option to rename INCOME & EXPENDITURE is provided to support all industries

• Flexibility to regroup within INCOME & EXPENDITURE

• Flexible Schedule numbering

• Generation of Schedules

• Export to Excel for further formatting if required.

For more details please click here