GST Returns

Convert transactions from B2B to B2C in bulk when GSTIN/UIN is inactive

How to Upload Vouchers to GSTR-1 under IFF Scheme Directly from TallyPrime 5.0

How to File GSTR-1 from TallyPrime 5.0

How to Download GST Returns in TallyPrime 5.0 for Reconciliation

How to Upload GSTR-1 Returns Directly from TallyPrime 5.0

Payment Declaration Form – GST PMT – 08: Definition, Format and Rules

What is Form GST PMT-08?

The Form PMT-08 is used to make payment of self-assessed tax by all quarterly taxpayers under the new GST returns system. This form shall be used in the first two months of the quarter. It is used for declaring and paying the tax liability and claiming the eligible input tax credit. It is to be used by 20th of the next month (for the first two months of the quarter). It will be followed by the filing of RET-1/2/3 by the 25th of the month following the quarter.

Since the taxpayer pays the monthly tax liability through this form, such a form is a replacement for the current form GSTR – 3B. Thus, GST PMT – 08 is used to declare and pay the tax liability and claim eligible input tax credit. Furthermore, the taxpayer must make the payment of self-assessed liabilities through GST PMT – 08 by the 20th of the month succeeding the month for which tax is to be paid. Once the payment is made, the taxpayer needs to file GST RET – 1, GST – RET 2 or GST RET – 3 by the 25th of the month following the quarter to which such a return pertains.

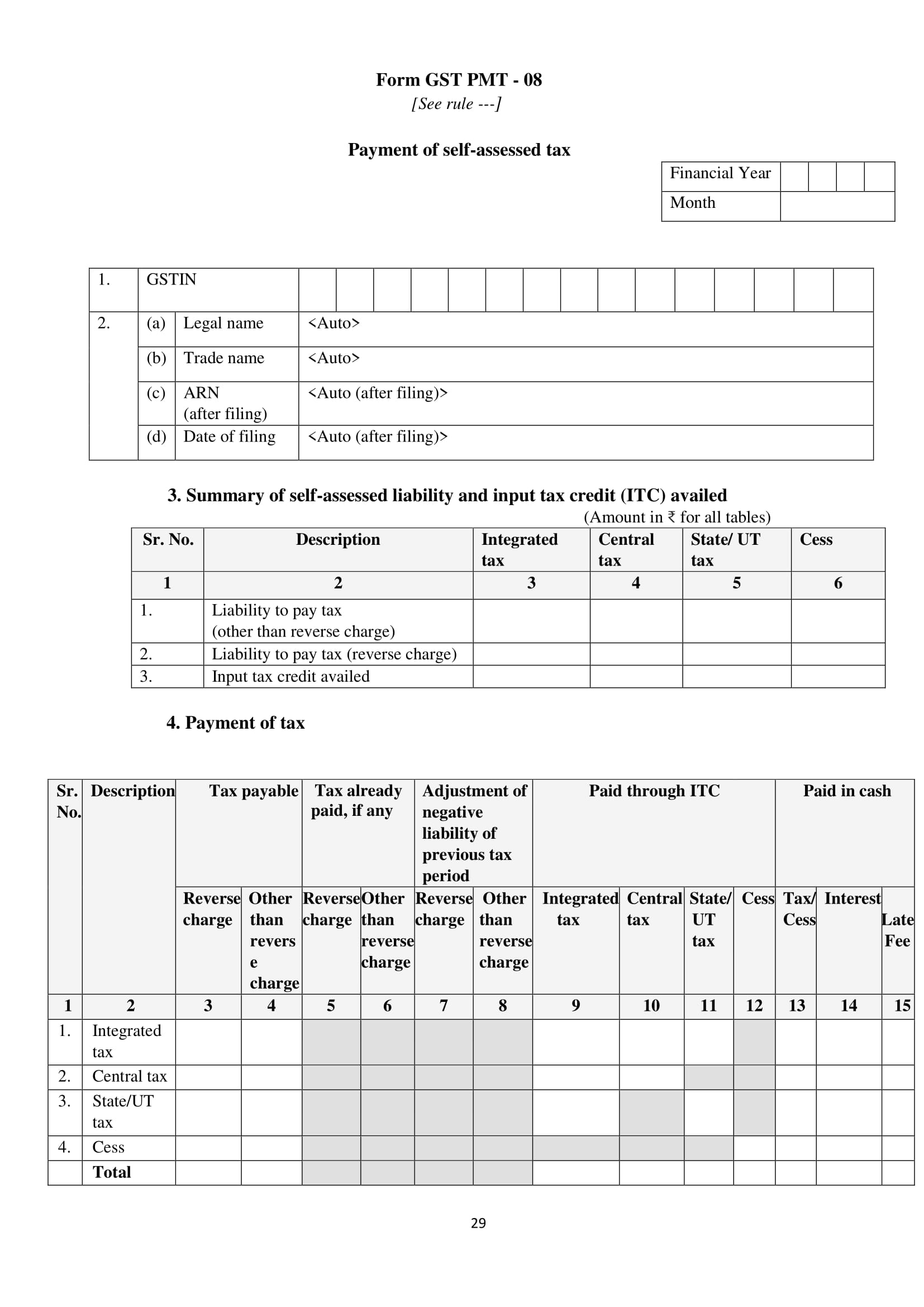

Format of GST PMT-08

Key things to keep in mind while filing GST PMT-08

- PMT-08 form applies to all returns i.e., SAHAJ, SUGAM, and Normal returns (quarterly filing only)

- A taxpayer who opts to do return filing on a quarterly basis needs to make a payment on a monthly basis depending on the supplies initiated within the month

- With the help of this form, only eligible ITC can be claimed

- Self-assessed liabilities will be paid for the initial two months of the quarter for quarterly filers and these amounts shall be populated to RET-1

- The credit of the tax paid within the initial two months of the quarter will be available at the time of return filing for the quarter

- Self-assessed liabilities will be paid within the 20th of every month

Liability can either be settled out of the balance in the electronic cash ledger or electronic credit ledger, whichever is applicable - Tax liability and input tax credit (ITC) availed will be based on self-assessment subject to the adjustment made in the main return of the quarter

- According to Section 50 of the Act, excess ITC claimed/short liability declared will be liable for interest charges. Hence, any late payment will draw interest as per the rate mentioned in Section 50 of the Act

- Also, the declaration in this form needs to be filed even if no supplies were initiated during the month

What is Form GST Anx-2 under New GST Return?

Under the New GST Return System, there will be one main return called the FORM GST RET-1 and two annexures i.e. FORM GST ANX-1 and FORM GST ANX-2. The return will have to be filed on a monthly basis, except for small taxpayers (taxpayers with a turnover up to Rs 5 crore) who can opt for the quarterly filing of returns.

What is FORM GST ANX-2?

FORM GST ANX-2 is an annexure to the main return FORM GST RET-1, and will have all the details of inward supplies, for the recipient of supplies to take action by either accepting or rejecting these documents, or marking them as pending, for action to be taken later. If the recipient accepts these documents, it means that the supplies reported in such documents by the suppliers in FORM GST ANX-1 are correct.

What are the contents of FORM GST ANX-2?

GSTIN: A taxpayer needs to input the GSTIN.

Basis details:Â Basic details such as trade name, legal name, etc. will be auto-populated on the basis of the GSTIN.

Inward supplies received from a registered person (other than the supplies attracting reverse charge), imports and supplies received from SEZ units / developers on Bill of Entry:Â The details will be entered as follows-

| Table No. | Name of the Table | Instructions |

| 3A | Supplies received from registered persons including services received from SEZ units | The details in these tables will be auto-populated from the following tables of the supplier’s FORM GST ANX-1 return:

3B – Supplies made to registered persons 3E – Supplies to SEZ units/developers with payment of tax 3F – Supplies to SEZ units/developers without payment of tax 3G – Deemed exports The recipient has the option to take action on the documents by either accepting, rejecting or marking them as pending. |

| 3B | Import of goods from SEZ units/developers on Bill of Entry | |

| 3C | Import of goods from overseas on Bill of Entry | |

| 4 | Summary of the input tax credit | This will be the total figure of input tax credit for the return filing period, based on action taken by the recipient of supplies such as:

Total credit on all documents that have been rejected Total credit on all documents that are kept pending Total credit on all documents that have been accepted |

| 5 | ISD credits received | This table is for reporting eligible input tax credit that has been received from an input service distributor. This needs to be entered document-wise. |

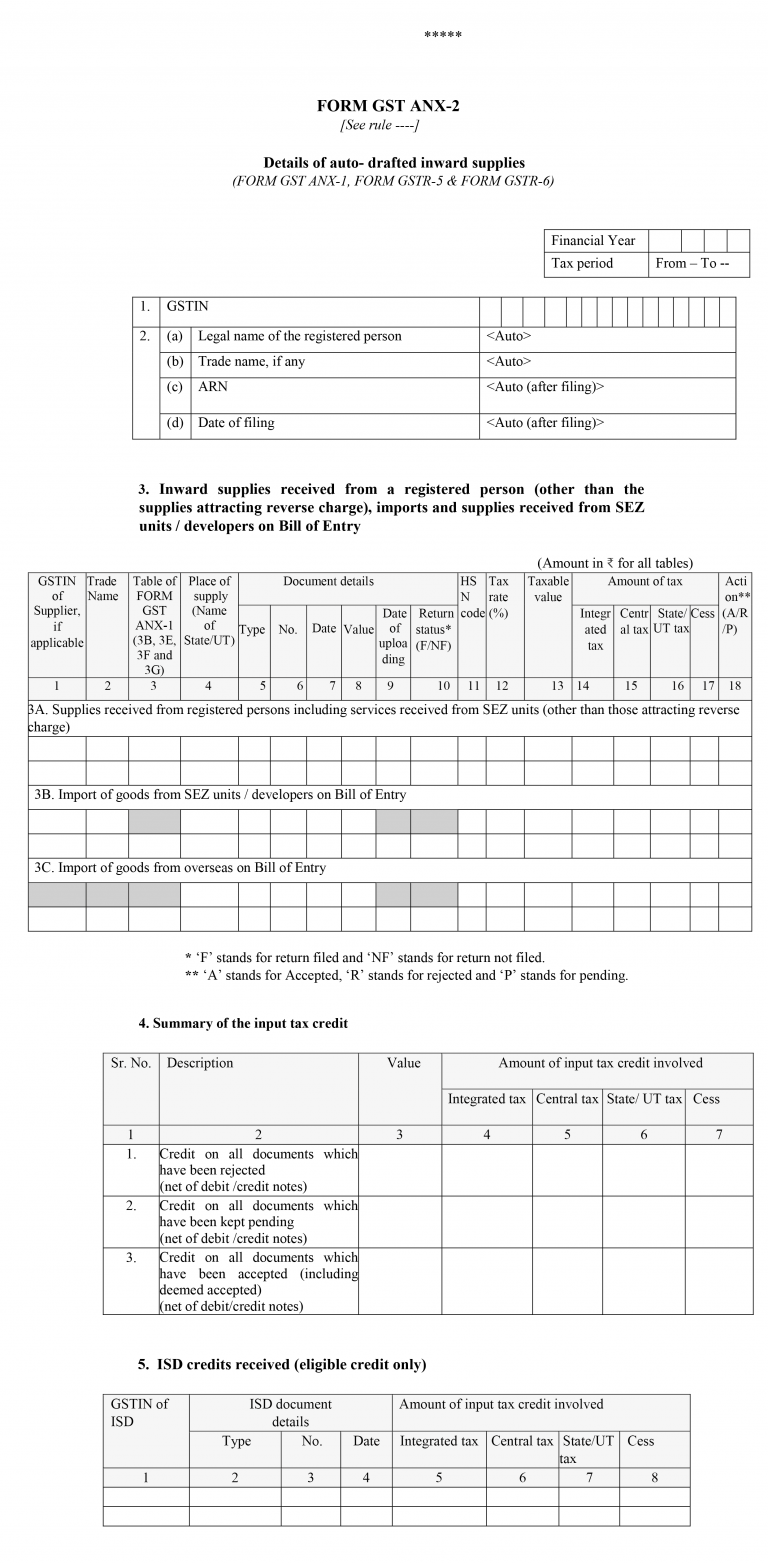

What is the format of FORM GST ANX-2?

Key things for taxpayers to keep in mind while filing GST ANX-2

- The supplier can upload documents continuously and on a real-time basis in FORM GST ANX-1 and will be auto-populated in this annexure i.e. FORM GST ANX-2

- The details of the documents uploaded by the supplier shall be available for the recipient in FORM GST ANX-2 to take action such as to accept, reject or to keep the document pending

- If a document is accepted by a recipient, it means that the document has been received before the recipient has filed his return and that the details reported by the supplier are correct

- Any corrections in the rejected documents can be made only by the supplier through his FORM GST ANX-1

- If a recipient marks a document as pending, this means he has deferred his action on the said document for a later date, of either accepting or rejecting the document. Input tax credit on these documents will not reflect in the main return i.e. FORM GST RET-1

- The supplier cannot amend pending invoices until they are rejected by the recipient

- The status of whether the supplier’s return is filed or not will be made known to the recipient in his FORM GST ANX-2. However, this does not affect the eligibility of the input tax credit available to the recipient, which will be decided as per the Act along with the rules made thereunder

- A separate functionality will be available to search for and reject an accepted document, on which credit has already been availed. This credit will be shown under reversal in table 4B(1) of FORM GST RET-1, which can be adjusted in table 4A(11) of the same return, in order to arrive at the amount of input tax credit that has been availed

- FORM GST ANX-2 will be deemed filed based upon the filing of the main return i.e. FORM GST RET-1 relating to the particular tax period

- If documents have been uploaded by a supplier in his FORM GST ANX-1, but he has not filed his return for the previous two consecutive periods, then the recipient will not be able to take credit on these documents even if the same is made available to him in his FORM GST ANX-2. However, the option will be available to reject or keep these documents pending. For suppliers who file their returns quarterly instead of monthly, then the term ‘two consecutive periods’ are replaced by ‘one quarter’

What is Form GST ANX-1 Under New GST Return?

What is FORM GST ANX-1?

FORM GST ANX-1 is an annexure to the main return GST RET-1 introduced under the new filing system of simplified returns under GST. This annexure will contain details of all outward supplies, inward supplies liable to reverse charge and import of goods and services. Details in this annexure will have to be reported invoice-wise (except for B2C supplies) based on continuous uploading facility to be made available on GST portal. The reporting can be done on a real-time basis, and will be available for the recipient of supplies to take necessary action in their FORM GST ANX-2.

What are the contents of FORM GST ANX-1?

A taxpayer needs to input the GSTIN and the basic details such as trade name, legal name, etc. will be auto-populated on the basis of the GSTIN.

Details of outward supplies, inward supplies attracting reverse charge and import of goods and services: The details will be entered as follows-

| Table No. | Name of the Table | Instructions | Notes |

| 3A | Supplies made to consumers and unregistered persons (Net of debit/credit notes) | All supplies that have been made to consumers and unregistered persons (i.e. B2C) need to be reported here. | The supplies need to be reported in a summary form tax rate wise and net of debit/credit notes.

HSN Codes are not required to be reported here. |

| 3B | Supplies made to registered persons (other than those attracting reverse charge) | All supplies (other than those which attract reverse charge) that have been made to registered persons (i.e. B2B) need to be reported here. Reporting of supplies made to entities (including Government departments) having a TDS or TCS registration need to be also reported here.

This would also include amendments, if any. |

Only the supply of services (NOT goods) made by an SEZ to a person located in a domestic tariff area (DTA) needs to be reported here.

The supply of goods by an SEZ to a person located in the DTA shall be reported in table 3K. The supply of goods or services made TO an SEZ unit shall not be reported here, but reported in table 3E or 3F, as the case may be. The ‘invoice value’ needs to be reported in column 6 and the ‘taxable value’ in column 9. For ex: If the taxable value is Rs 200, the tax at 18% will be Rs 36, hence the total invoice value will be Rs 236. |

| 3C & 3D | Exports with/without payment of tax | All exports with payment of tax (i.e. Integrated tax or IGST) need to be reported in table 3C, while exports without payment of tax need to be reported in table 3D. | The shipping bill number / bill of export number that is currently available as on the date of filing of return needs to be reported against the export invoices.

The details of the remaining shipping bills can be reported after filing of the return. A separate functionality for updating details in table 3C 3D will be made available on the portal. |

| 3E & 3F | Supplies to SEZ units/developers with/without payment of tax | All supplies made to SEZ units / developers with payment of tax need to be reported in table 3E, and supplies made without payment of tax need to be reported in table 3F. This includes amendments, if any. | For supplies made with the payment of tax, the supplier will have an option to select if either he will claim refund on such supplies or the SEZ unit. The SEZ unit is eligible to avail input tax credit and claim a refund on unutilised credit after export, ONLY if the supplier is not availing such refund. |

| 3G | Deemed exports | All supplies treated as deemed exports need to be reported here. This would include amendments, if any. | The supplier has the option to declare if the refund will be claimed by him, or the recipient of deemed export supplies. If the refund is claimed by the supplier, then the recipient will not be eligible to avail input tax credit on such supplies. |

| 3H | Inward supplies attracting reverse charge (to be reported by the recipient, GSTIN wise for every supplier, net of debit/credit notes and advances paid, if any) | All inward supplies which attract reverse charge need to be reported here by the recipient. The details have to be reported GSTIN-wise and not invoice-wise. | Advances paid on such supplies shall be declared in the month in which the advance was paid.

The value of supplies reported shall be net of the following: debit/credit notes, and -advances on which tax has already been paid at the time of payment of advance, if any. If only an advance has been paid to the supplier, and no invoice or supply received, then on reporting the same, this credit shall reflect in the main return (FORM GST RET-1), but needs to be reversed in table 4 of the said return. This credit can be availed only on receipt of the supply and issue of invoice by the supplier. |

| 3I | Import of services (net of debit/ credit notes and advances paid, if any) | Services which have been imported need to be reported here. | The value of supplies needs to reported net of debit / credit notes, and advances paid, on which tax has already been paid at the time of payment of advance.

The amount of advance paid needs to be declared in the month in which the same was paid. Details are not required to be reported invoice-wise in this table. Services received from SEZ units / developers shall not be reported in this table. If only an advance has been paid to the supplier, and no invoice or supply received, then on reporting the same, this credit shall reflect in the main return (FORM GST RET-1), but needs to be reversed in table 4 of the said return. This credit can be availed only on receipt of the supply and issue of invoice by the supplier. |

| 3J | Import of goods | The details of taxes paid on the import of goods need to be reported here.

These goods were subjected to IGST at the time of import, and are hence not subjected to tax once again while filing this return. The amount of IGST and cess paid at the port of import needs to be reported here, in order to avail input tax credit. |

Any reversal done due to ineligibility of credit or otherwise is to be carried out in table 4B of the main return (FORM GST RET-1). |

| 3K | Import of goods from SEZ units / developers on a Bill of Entry | Goods received from SEZ units / developers on a Bill of Entry need to be reported here by the recipient.

These goods were subjected to IGST at the time of clearance into the DTA, and are hence not subjected to tax once again while filing this return. |

The SEZ unit making such supplies should not include such outward supplies in table 3B.

The reporting in table 3J and 3K shall be required till such time the data from ICEGATE and SEZ to GSTN system starts flowing online. |

| 3L | Missing documents on which credit has been claimed in T-2 /T-1 (for quarter) tax period and supplier has not reported the same till the filing of return for the current tax period | The recipient needs to provide document-wise details of the supplies for which credit has been claimed but the details of supplies are yet to be uploaded by the supplier(s) concerned as detailed below:

(i) Where the supplier has not reported supplies even after a lapse of two tax periods in the case of monthly return filers and after a lapse of one tax period in the case of quarterly return filers.

(ii) Where the supplier uploads the invoice after the recipient reports the same in this table, then such credit needs to be reversed by the recipient in table 4B(3) of the main return (FORM GST RET-1) as this credit cannot be availed twice. |

|

| 4 | Details of the supplies made through e-commerce operators liable to collect tax under section 52 (out of any outward supplies declared in table 3) | All supplies made through e-commerce operators liable to collect tax under section 52 shall be reported here at a consolidated-level in this table even though these supplies have already been reported in table 3. |

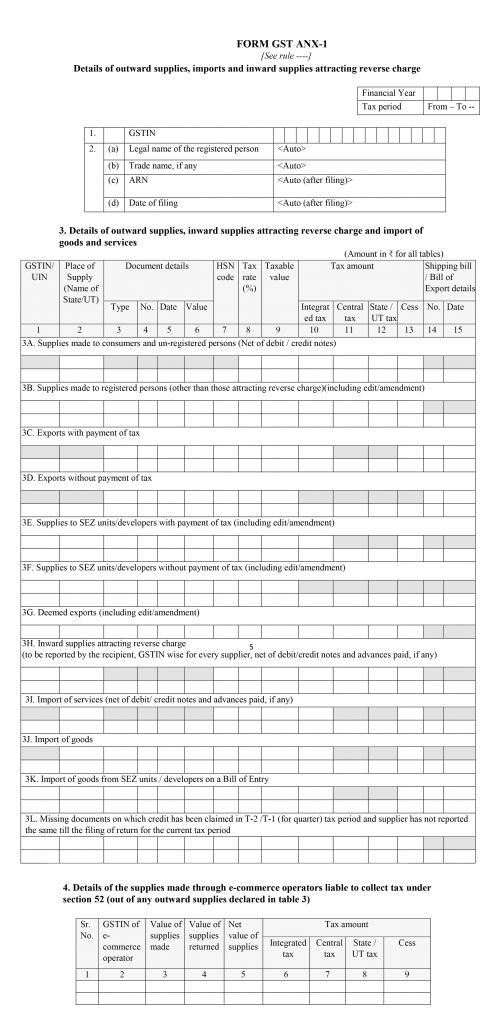

What is the format of FORM GST ANX-1?

Important pointers taxpayers should know while filing FORM GST ANX-1?

- The supplier can upload documents continuously and on a real time basis

- The documents issued during a particular tax period or for any other prior period, which have been uploaded by him in the current return filing period, shall be accounted towards the tax liability of the supplier in whichever return these details have been uploaded

- The recipient will get input tax credit during a tax period based on documents uploaded by the supplier till the 10th of the month following the month for which the return is being filed for, or the10th of the month following the quarter in case of quarterly filers

- The details of the documents uploaded by the supplier shall be available for the recipient in FORM GST ANX-2 to take action such as to accept, reject or to keep the document pending

- Supplies which attract reverse charge need to be reported only by the recipient and not by the supplier in this annexure

- The place of supply (POS) has to be reported for all supplies, and this requirement is mandatory. In the case of intra-State supplies, the POS will be the State in which the supplier is registered

- The tax rate applicable on IGST supplies can be selected from a drop-down menu. For intra-State supplies, the tax rate will be half the tax rate of Integrated tax, to be split equally between Central tax and State / UT tax. Cess should be reported under the cess column if it is applicable

- Wherever supplies are reported net of debit/credit notes, even if the values become negative in any particular cases, the same can be reported as it is

- All suppliers with an annual aggregate turnover over Rs 5 crores, and in relation to imports, exports, and SEZ supplies have to upload HSN-level data., whereas other taxpayers (with annual aggregate turnover up to Rs 5 crores) can report HSN codes on an optional basis in the relevant table, or leave the same blank

- The tax amount shall be computed by the system based on the taxable value and tax rate. The tax amount so computed cannot be edited, except by issuing debit/credit notes. However, the amount under Cess will be reported by the taxpayer himself

- Any documents rejected by the recipient shall be conveyed to the supplier only after filing of the return by the recipient

- The new return system provides for editing or amendment of details only from the supplier’s side. The recipient can reset, unlock or reject a document, however, the option to edit or amend a document shall be made available to the supplier only

- The rejected documents can be edited before filing any subsequent return for any month or quarter by the supplier, and the credit of the same will be available to the recipient in the next open FORM GST ANX-2. The liability for such edited documents, however, will be accounted for in the tax period in which the supplier has uploaded the documents.

- In situations where the particulars of the document may be correct but the document has been reported in the wrong table. A facility of shifting these documents to the appropriate table will be provided in such cases so that these rejected documents can be shifted instead of needing to amend them

- A supplier can, at any time, amend documents relating to supplies made to persons such as composition taxpayers, ISD, UIN holders etc., and the same shall not be dependent upon the action taken (accept/reject/pending) by the recipient

- Documents belonging to the previous period prior to the current return filing system can be uploaded in the relevant tables of this annexure. Only those details can be uploaded which have not been included in the erstwhile FORM GSTR-1

Shifting to New GST Return: How to Prepare for the Change

The introduction of the new GST return system aimed at simplifying the tax filing regime for business owners across India. The current GST return filing will shift from GSTR-1 and GSTR-3B to a new single return RET-1/2/3 with an auto-filled ANX-1 (for tax liability) and ANX-2 (for Input Tax Credit). The new GST return filing mechanism will be focussed on allowing input tax credit based on the actual invoices uploaded by the supplier.

How to Prepare for the transition to the New GST Returns

If turnover is more than Rs 5 crore, a taxpayer will need to file the return (Normal Monthly) and make the tax payment on a monthly basis. If turnover is less than or equal to Rs 5 crore, a taxpayer will have the following three options to choose from:

·      Normal Quarterly

Return filing frequency will be on a quarterly basis. Tax payment needs to be done on a monthly basis. Applicable to any type of sales.

- Sahaj: Return filing frequency will be on a quarterly basis. Tax payment needs to be done on a monthly basis. Applicable only to B2C suppliers.

- Sugam: Return filing frequency will be on a quarterly basis. Tax payment needs to be done on a monthly basis. Applicable to B2B or B2C suppliers

·      Switching between return types

A taxpayer can switch only once in a financial year from Quarterly (Normal) to Sahaj or Sugam. The switch has to be initiated at the beginning of any quarter.

A taxpayer can switch only once in a financial year from Sugam to Sahaj. The switch has to be initiated at the beginning of any quarter. A taxpayer can switch more than once in a financial year from Sahaj to Quarterly (Normal) or Sugam.

The change has to be initiated at the beginning of any quarter. A taxpayer can switch more than once in a financial year from Sugam to Quarterly (Normal). The change has to be initiated at the beginning of any quarter.

·      Claim provisional ITC

A taxpayer who opts to file returns on a monthly or a quarterly (GST RET-1) basis would qualify to claim provisional Input Tax Credit (ITC) on missing invoices. However, the credit of missing invoices will not be applicable to a taxpayer who opts to file Sahaj (GST RET-2) or Sugam (GST RET-3).

·      Necessary actions on invoices

A taxpayer will need to accept, reject, or keep the supplier invoices as pending as necessary. A taxpayer has to take appropriate actions on the invoices uploaded to claim ITC between 11th and 20th of the month.

·      Modify ERP systems

The existing Enterprise Resource Planning (ERP) Systems will need to be modified in order to comply with the new GST returns. A few modifications include (not limited to): Bifurcation of capital goods and input services, Details related to Bill of Entry has to be included, Bifurcation of eligible and ineligible purchases and a single debit/credit note has to be linked with multiple invoices of a vendor.

·      Know other key changes

A taxpayer will need an HSN code for submitting details at a document level versus an individual HSN summary. B2B supplies which are accountable for reverse charge mechanism (RCM) need not be shown in the GST ANX-1 by the supplier. Nevertheless, the aggregate figure has to be shown in GST RET-1. The recipient of supplies has to declare the inward supplies which are liable for RCM in GST ANX-1.

·      File a NIL return

If a taxpayer is liable for a monthly return filing but hasn’t made any purchases or has no output tax liability and ITC to avail in any quarter, he or she will have to file one Nil return for the entire quarter versus monthly returns. The taxpayer needs to report Nil transactions through an SMS in the first and second month of the quarter.