Splitting Company Data after finalization of accounts.

Introduction

Tally’s flexible period-less accounting permits the entry of data for any number of years. This feature has tremendous benefits. The presence of voluminous old data creates unnecessary load on the system.

Splitting a financial year enables you to retain most of the benefits while overcoming this system overhead.

When you split the data, two things happen:-

1. New companies are created for the respective split periods.

2. The entire data is retained in the original company.

How to Split Company Data :

I. For Tally.ERP 9 Release 2.1 and Lower Releases (including Tally 9)

Pre-split activities

Before you split the data, ensure that:

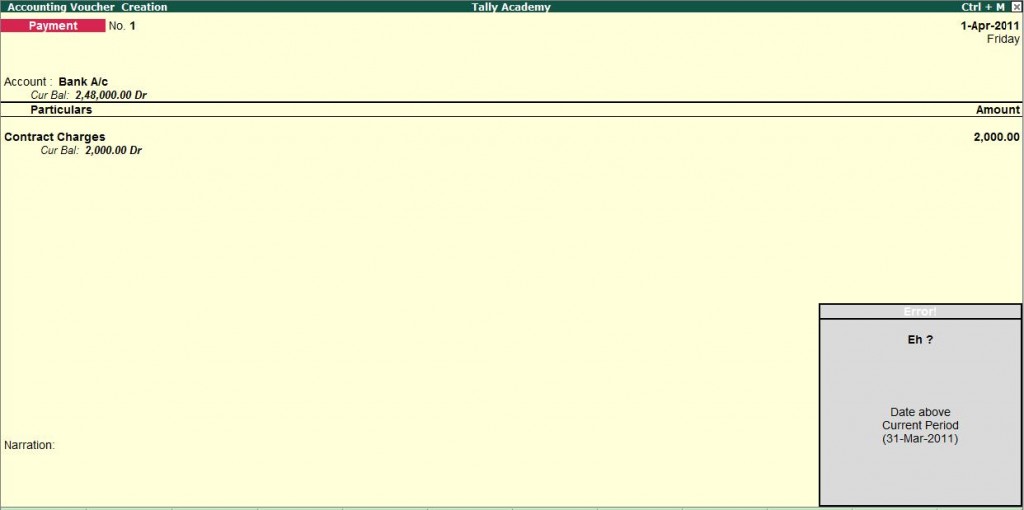

- All adjustment forex gains/losses have been fully adjusted using Journal entries. Verify that the item “Unadjusted Forex Gains/Loss” does not appear in the balance sheet

- There are no pending purchase bills/sales bills. Check the profit and loss account and inventory statements for pending purchase/sales bills. You may account them to the respective party accounts or to the respective “bills pending†accounts.

- Ensure that all the Bank Vouchers are reconciled from Bank Reconciliation statement.

- Ensure that a Backup of the data has been taken

Procedure to Split the Financial Years

- Go to Gateway of Tally, Select Alt+F3: Cmp Info.

- Select Split Company Data.

- Select the Company whose data is to be split.

- Tally recommends the split from date based on the existing data. It is recommended that the Split Point is set as the beginning of the latest financial year, though Tally permits any date as the split point.

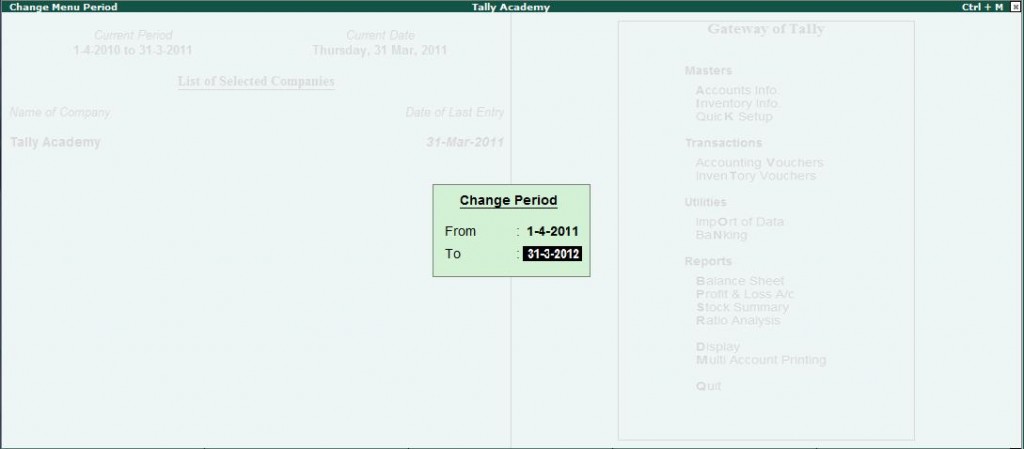

- Splits occur in sets of two periods. Hence, start with the latest. For example, you need to split a company’s four years data (1-4-2008 to 31-03-2012) into four separate “companiesâ€, each with a particular financial year. Select the beginning of the latest financial year first (1-04-2011).

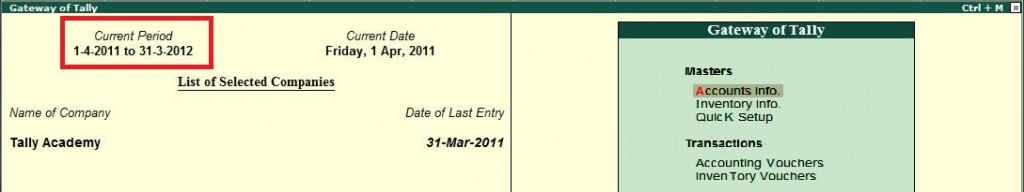

- On confirming the periods, two new companies will be created – one with data from 1-4-2008 to 31-03-2011, i.e., for three years, and the other for the period 1-4-2011 to 31-03-2012.

The historical data, for one or more financial years, will be preserved as a single company, and the current financial year, will be preserved as another company. Normally there is no reason or benefit to split the earlier years again into separate companies. If you wish to do so, repeat the steps mentioned above for the earlier period (1-4-2008 to 31-03-2009, 1-4-2009 to 31-03-2010 & 1-4-2010 to 31-3-2011).

All the companies are full companies in their own right. Data can be entered, displayed and altered. Please print the key financial reports (Trial Balance, Balance Sheet, Profit & Loss, and Stock Summary etc.) for each company for the relevant periods and compare them for accuracy.

Once you are satisfied that you have a successful split, it is advisable to take a backup of the original company and permanently delete its data from the hard-disk. This will prevent any accidental entry of fresh data into the old database.

To delete a company, press Alt+F3 at the Gateway of Tally, select a company to Alter it, and at the point where you can modify the Company Information, press Alt+D.

You will also need to alter the names of the two freshly created companies as per your requirement.

II. For Tally.ERP 9 Release 3.0 and Above

Pre-split activities

Before you split the data, ensure that:

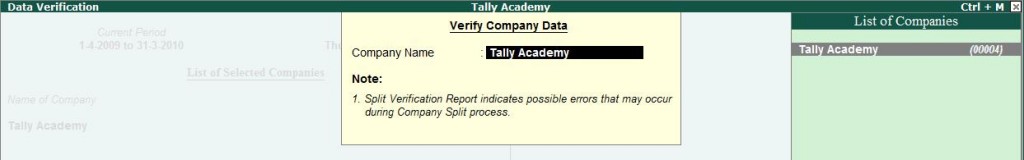

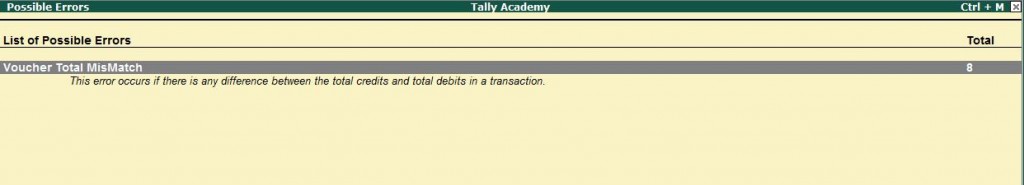

- Verify Company Data Utility: Verify Company Data is a built-in utility which detects the possible error that occurs on data verification and provides the respective reason for the error detected. Further, it prompts the user to rectify the listed error with possible solution so that the same errors do not reoccur in future. The user has a choice to resolve these errors manually or by using the helper available.

- All adjustment forex gains/losses have been fully adjusted using Journal entries. Verify that the item “Unadjusted Forex Gains/Loss” does not appear in the balance sheet

- There are no pending purchase bills/sales bills. Check the profit and loss account and inventory statements for pending purchase/sales bills. You may account them to the respective party accounts or to the respective “bills pending” accounts.

- Ensure that a Backup of the data has been taken

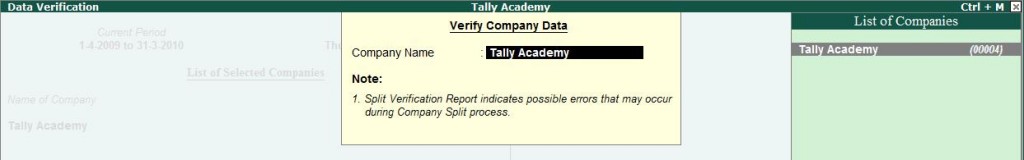

Verify Company Data

To start the data verification process before splitting the data:

- Go to Gateway of Tally > F3: Cmp Info. > Split Company Data > Verify Company Data

- Select the required company

- Press enter to view the Possible Errors screen.

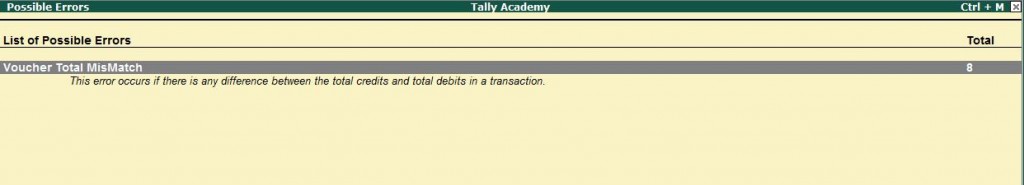

The Possible Errors screen is displayed as shown

Possible Error screen display the Errors, Reason for the Error

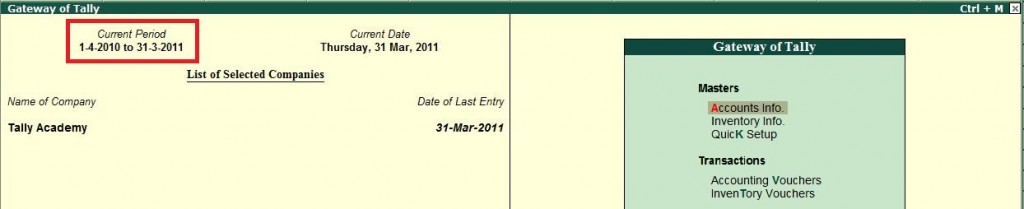

Procedure to Split the Financial Years

- Go to Gateway of Tally, Select Alt+F3: Cmp Info.

- Select Split Company Data.

- Select the Company whose data is to be split.

- Tally recommends the split-off date based on the existing data. It is recommended that the Split Point is set as the beginning of the latest financial year, though Tally permits any date as the split point.

- Splits occur in sets of two periods. Hence, start with the latest. For example, you need to split a company’s four years data (1-4-2009 to 31-03-2012) into four separate “companies”, each with a particular financial year. Select the beginning of the latest financial year first (1-04-2011).

The Split Company Data screen displays as shown:

- On confirming the periods, two new companies will be created – one with data from 1-4-2008 to 31-03-2011, i.e., for three years, and the other for the period 1-4-2011 to 31-03-2012.

The historical data, for one or more financial years, will be preserved as a single company, and the current financial year, will be preserved as another company. Normally there is no reason or benefit to split the earlier years again into separate companies. If you wish to do so, repeat the steps mentioned above for the earlier period (1-4-2008 to 31-03-2009, 1-4-2009 to 31-3-2010 & 1-4-2010 to 31-03-2011).

All the companies are full companies in their own right. Data can be entered, displayed and altered. Please print the key financial reports (Trial Balance, Balance Sheet, Profit & Loss, and Stock Summary etc.) for each company for the relevant periods and compare them for accuracy.

Once you are satisfied that you have a successful split, it is advisable to take a backup of the original company and permanently delete its data from the hard-disk. This will prevent any accidental entry of fresh data into the old database.

To delete a company, press Alt+F3 at the Gateway of Tally, select a company to Alter it, and at the point where you can modify the Company Information, press Alt+D.

You will also need to alter the names of the two freshly created companies as per your requirement.