In a bid to simplify the GST compliance, the GST Council has proposed the new GST returns expected to be introduced from 1st October,2020.  Considering the diversity of businesses operating in the country, different returns forms supported with annexure are proposed as a part new return framework.

while the idea of different returns for different business aims at simplifying the GST compliance, businesses are recommended to carefully asses the business profile, their vendors, supply type etc. and accordingly choose the one which suits the most.

Having said there are different returns, the immediate question which comes to mind is what are the returns that are available on the GST shelf? Which return should I shop on the GST portal?

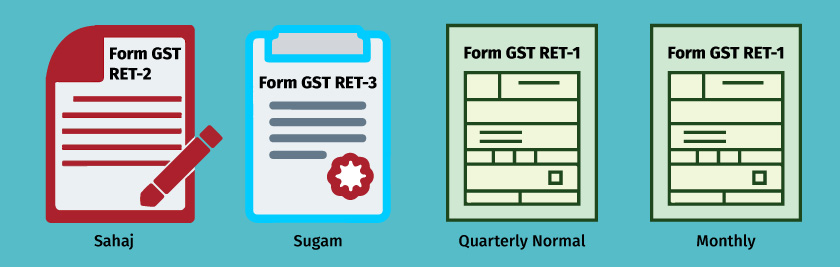

Let’s understand the different returns forms and annexures introduced in the new GST returns.

Return forms and Annexure in new GST Returns

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details of document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-1 (Monthly) | Form RET-1 is a monthly return to be filed by the businesses having aggregate turnover over more than 5 Crores in a financial year. | Business needs to file the monthly return by 20th of the subsequent month. |

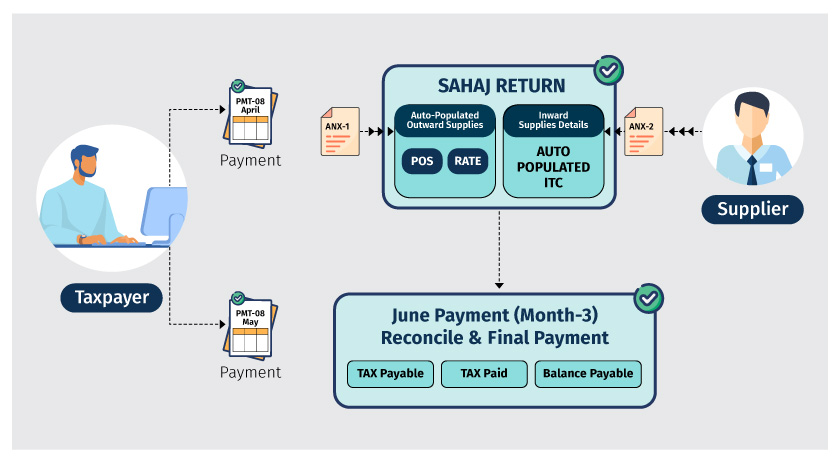

| Form RET-2 | Form RET-2 is a quarterly return applicable for business opting Sahaj returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

| Form RET-03 | Form RET-02 is a quarterly return applicable for business opting Sugam returns (up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

| Form RET-1(Quarterly) | This is similar to monthly return but applicable for business having aggregate turnover up to 5 crores. | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

As detailed in the above table, the main return will be supported by the annexures. Every return is supported by two annexures, one for reporting the outward supplies (liability) and the other one for inward supplies (ITC).

Among the main returns, you need to choose and file only one return which is suitable for your business profile.  Choosing the right GST return is key for simplification and assessing your business profile inline with new return types is must. This because each return form has its own implication on the Input tax credit.