How to provide the opening balance for Input Tax Credit in a new Company?

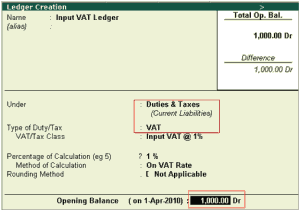

Yes, it is possible to provide the Opening Balance for Input Tax Credit in a newly created company by giving the amount in the Opening Balance field followed by Dr for the Input VAT Ledger grouped under Duties & Taxes and Type of Duty/Tax as VAT. The opening balance will be displayed in the VAT Computation and the respective Forms. Selection of Vat/Tax class is optional.

8 comments on “Opening balance for Input Tax Credit”

input tax credit come under which group?

Dear Rajesh,

You can create input tax credit ledger under Current Assets or Duty and Taxes group

even i got the same doubt, whether to show input tax credit under current assets or duty and taxes group and thank you

and one more doubt, can you tell me the journal entry for set off of out put tax with input tax credit in tally ?

Dear Gopi

You have to create Vat Adjustment Class in Journal Voucher

Gateway of Tally > Accounts Info > Voucher Types > Alter > Journal

In name of Class

Vat Adjustment

Use Class for VAT Adjustment : Yes

and save it

Then Pass entry in journal voucher with class

Dr. Output vat

Cr. Input Vat

Best Wishes

Admin

Dear Gopi,

Input Tax Credit should be under Current Asset

Best Wishes

Admin

Sir,

Duty & Tax always Dr/Cr Balance ?

Dear Subrata,

If your duty and Tax is debit balance means you have refund and if credit balance means it is payable

Regards

Admin