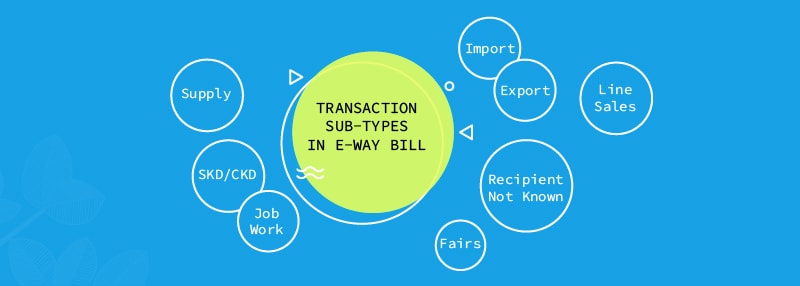

In this blog, we will go through the various transaction sub-types in e-way bill, which are available as options, and what each sub-type represents.

Transaction types in e-way bill

On the e-way bill portal, once you start to fill up the form to generate a new e-way bill, you will come across a section called “Transaction Detailsâ€. The first field within this section is “Transaction Typeâ€.

Now, if we recall the e-way bill rules, they state that an e-way bill is liable to be raised for primarily the following reasons –

- In relation to a supply

- Supply made for a consideration (payment) in the course of business

- Supply made for a consideration (payment) which may not be in the course of business

- Supply without consideration (without payment)

- For reasons other than supply – which includes job work, removal for testing purpose, send on approval basis etc.

- Due to inward supply from an unregistered person

Based on the above mention e-way bill rules, the options are available in the e-way bill portal. In the “Transaction Type†field, you will need to select either “Outward†or “Inwardâ€. You need to select the option as “Outwardâ€, if you are supplying goods and select “Inwardâ€, if you are receiving goods.

Based on what you select, the relevant options will show up for the “Transaction Sub-Type†field, which are as follows:

- Outward

- Supply

- Export

- Job Work

- SKD / CKD

- Recipient Not Known

- For Own Use

- Exhibitions or Fairs

- Line Sales

- Others

- Inward

- Supply

- Import

- SKD / CKD

- Job Work Returns

- Sales Return

- Exhibition or Fairs

- For Own Use

- Others

Various transaction sub-types in e-way bill portal

Let us understand the various special kinds of transaction sub-types in e-way bill, which we can see above:

Supply – As discussed above, it will cover supplies made for a consideration in the course of business, supply made for a consideration which may not be in the course of business and supply without consideration. This will cover Inward Supply, Outward Supply, Sales Returns etc.

Export / Import – Inward supplies and outward supplies across country borders

Job Work / Job Work Returns – As discussed above, job work is included under “Reasons other than supplyâ€. In addition to the normal job work scenarios, you need to be aware of the inter-State job work scenario, wherein an e-way bill is mandatory, irrespective of the value of the consignment. Also, as per the recent changes in e-way bill rules, when goods are sent by a principal located in one State or Union territory to a job worker located in any other State or Union territory, the e-way bill can be generated either by the principal or the registered job worker as well.

SKD / CKD – SKD stands for “Semi Knocked Down†and CKD stands for “Completely Knocked Down’ which indicates the condition of goods while in transit. An example could be, movement of fan in different parts, which will be assembled later. Depending on whether a consignment is semi knocked down or completely knocked down, the e-way bill needs to be generated.

Recipient Not Known – If we study the e-way rules, especially pertaining to unregistered dealers, we will understand that the recipient may be deemed as known or unknown, based on the knowledge available to the supplier at the time of commencement of movement of goods. In certain business models, unregistered suppliers manufacture goods at their place, and then bring the goods for sale to a common market, where lot of buyers are available. In such a situation, the unregistered supplier will obviously not know at the time of movement of goods, who he is ultimately going to sell the goods to. In such a situation, the e-way bill is not mandatory. However, the unregistered supplier will still have an option to generate the e-way bill. Thus, in case the unregistered dealer chooses to generate an e-way bill under such a scenario, the option “Recipient Not Known†in e-way bill generation screen, will be chosen.

For Own Use – This will be applicable for branch transfers or stock transfers etc.

Exhibition or Fairs – Applicable for Casual Taxable Persons who cause movement of goods for display and sale at exhibitions or fairs at a place, where he does not have a permanent establishment.

Line Sales – Line sales in GST basically imply vertical sales which are made from one unit / department / division of an organisation to another unit / department / division, which is next in the production line. This basically holds true for goods which are output for one process being transported as input for the subsequent process. Line sales in GST is thus an important transaction sub-type to be considered, as “line sales†in e-way bill generation screen will need to be selected.

In conclusion, it is important for businesses to know which transaction sub-type to choose for which business scenario, so that the e-way bill can be generated smoothly and with the right information.

4 comments on “Transaction Sub-Types in E-way Bill”

This was a wonderful read. However, you can visit entransact.com to generate e-Way Bills in case of any difficulty. This portal will take care of all your e Way Bill requirements.

Thanks for explaining the transaction sub-types in e-way bill

Your article is vey helpful

This was a wonderful read. However, you can visit entransact.com to generate e-Way Bills in case of any difficulty. Thank you.

I’m renting a plant for manufacturing. I’m getting raw material from IOCL which is invoiced in my address. How can I generate a e-way bill to transfer the raw material to the rented plant.