Month: March 2020

Use Your Tally.ERP 9 Company from Anywhere

When your business needs the flexibility to access your data from anywhere, you can use the remote capabilities of Tally.ERP 9 for the same. Tally.ERP 9 provides support for accessing your company data using in-built Remote Access feature and Browser Access feature. In your office you need to have a valid Tally.ERP 9 license, an active TSS, an internet connection, and your company connected to Tally.NET services. You can also use Tally.ERP 9 on the computer in your office using third-party remote desktop (RDP) tools.

With the remote access capability, you can have your business data at your fingertips, even when you are attending a business meeting or out on a trip. If you or your employees want to work from home, or access the company data from the client location, Tally.ERP 9 remote capabilities come in handy.

Security and Control : You have complete control on who can access your company, and which features are available to the user. Further, your data will always be in your computer. Whenever a user connects to your company, based on the access permissions you have provided, the user can access the required features.

Audit Accounts : You can also allow your auditor to do verification of your books, if needed. If you are a Chartered Accountant, you can use your Tally.NET ID to get access to your clients’ data by making them give you access to their companies.

You can avail any of the following features based on your needs.

â— Remote Access – to record or alter your transactions, view reports, and print vouchers or reports.

â— Browser Access – to view or print reports and vouchers from any device.

â—Â Use RDP to access your computer where Tally.ERP 9 is installed, and work. To access your computer using RDP, you need to use third-party tools like Microsoft RDP, Citrix, VPN, TeamViewer, and so on.

You may use Tally.ERP 9 in Educational Mode or through a Rental License .

GST Return Filing Date for March-May Extended till June Amid Corona Virus

The government on March 24 announced extension of the last date for filing GSTR-3B for Goods and Services Tax (GST) for March, April and May to June 30, amid the Corona Virus chaos. “Others can file returns due in March, April and May 2020 by last week of June 2020 but the same would attract a reduced rate of interest at 9 percent per annum from 15 days after due date (current interest rate is 18 % per annum),” she said.

Bigger companies, the FM said, would have to pay only interest but no late fee or penalty will be imposed. “No late fee and penalty to be charged, if complied with before or till 30th June 2020,” she said.

In a press conference, Sitharaman announced some crucial measures to fight the economic fallout of Covid-19 pandemic. The government also extended the date till the last week of June, for opting for composition scheme. “Further, the last date for making payments for the quarter ending 31st March, 2020 and filing of return for 2019-20 by the composition dealers will be extended till the last week of June, 2020,” the FM said.

The date for filing GST annual returns of 2018-19, which was due on March 31, has been extended till the last week of June. “Due date for issue of notice, notification, approval order, sanction order, filing of appeal, furnishing of return, statements, applications, reports, any other documents, time limit for any compliance under the GST laws where the time limit is expiring between 20th March 2020 to 29th June 2020 shall be extended to 30th June 2020,” the government said.

Sitharaman also extended the deadline for filing FY19 income tax (I-T) returns till June 30. ATM charges have been scrapped till June 30.

FORM RET 1 – Quarterly GST Return

In the 31st meeting of GST Council, it was recommended to introduce and implement a new GST return system. One of the key aspects of the new GST return system is the introduction of different types of return forms considering the business profile. Quarterly return form RET-1 is one such return type designed for small taxpayers.

In this blog, let us understand the applicability, return filing period and format of quarterly return form RET-1

What is quarterly return form RET-1?

Quarterly Return form RET-1 is a return type for small taxpayers whose aggregate turnover in the financial year does not exceed 5 Crores and their outward supplies consist of B2B B2C and all other types supplies such as exports, SEZ etc.

To put it in simple words, businesses opting quarterly return form RET-1 will be allowed to make all types of outward supplies such as supplies to end consumers, unregistered business, registered business, exports, SEZ etc.

Except for the periodicity of filing return, the form type, format and details required to be furnished are similar to monthly returns.

Periodicity of filing quarterly return form RET-1

The periodicity of filing quarterly return form RET-1 is similar to the Sahaj and Sugam. You need file the returns quarterly with a monthly payment of tax on a self-assessed basis. The due date to file a quarterly return in Form RET-1 is 25th of the subsequent month following the quarter-end.

The due date for filing Sugam GST returns is given below

| Quarterly Return Form RET-1 | |

| Quarters | Due Data |

| April -June | 25th July |

| July – September | 25th October |

| October- December | 25th January |

| January-March | 25th April |

Due date for payment of tax

Though the return filing periodicity is quarterly, businesses opting quarterly RET-1 are required to make the monthly payment.

The tax payment is on the self-assessed basis and the payment declaration challan known as Form GST PMT -08 should be used to remit the payment. The due date to remit the monthly payment is 20th of the subsequent month.

Types of supplies allowed under quarterly GST Return Form RET-1

Business opting quarterly return Form RET-1 will be allowed to make all types of supplies as mentioned in the below table.

| Type of Outward Supplies | Allowed (Yes) / Disallowed (No) |

| B2B transactions | Yes |

| B2C transactions | Yes |

| Exports | Yes |

| SEZ units/developers | Yes |

| Deemed Exports | Yes |

| Outward Supply to e-Commerce Operators | Yes |

| Nil Rated, Exempted or Non – GST | Yes |

| Inward supplies attracting RCM | Yes |

| Import of goods/services | Yes |

| Import of Goods from SEZ | Yes |

Difference between Sahaj, Sugam and quarterly return form RET-1

All these returns are quarterly and designed for small taxpayers. The first difference, the obvious one is that each of these returns differs basis nature of supplies it supports. Sahaj supports only B2C supplies, Sugam supports B2C as well as B2B supplies and quarterly return form RET-1 support all types of supplies.

Second, the most important one, the facility of availing ITC on the missing invoice (invoices not uploaded by the supplier) and reporting of such bills is allowed for businesses opting monthly return and quarterly return in form RET-1. In other words, businesses who have opted Sahaj return and Sugam return will not be allowed avail ITC on the missing invoice.

Quarterly return form RET-1 return filing process

The quarterly return form RET-1 consist of one main return, to be filed on a quarterly basis supported by two main annexures. Form GST RET-1 is the return form to be used to file Sugam returns supported by the annexures.

The details of return forms and annexures to be used for filling Sugam return is given below.

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-1 | Form RET-1 is a quarterly return applicable for business opting Sugam returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

How to Transit to e-Invoice System?

With the introduction of e-Invoice concept, the businesses will be mandated to validate and authenticate the invoices by the government portal. Before getting into the ways to transit to a new system of e-invoicing, let us understand the current practice.

Current Practice Vs E-invoicing in GST

Today, every business whether big or small, create invoices using various accounting /ERP software and some even through a manual process. As a supplier, these invoice details are furnished in GSTR 1 and the buyer gets the visibility of invoices uploaded in GSTR -2A.

With e-invoicing, the current practice of generating the invoice and reporting will change.e-Invoice requires B2B invoices to be authenticated electronically by IRP (Invoice Registration portal).

The concept of e-invoice begins with uploading of e-invoice data in the prescribed format (JSON) to the IRP system and post validation, a unique number called ‘Invoice Registration Number (IRN)’ is generated for every invoice uploaded. Along with IRN, the e-invoice is tagged with a QR code for further use by various Government portal like GSTN or E – Way Bill portal.

If you closely look at the current and e-invoice system, two changes are evident. First, the need to get the invoice authenticated with IRN. Remember, an invoice without IRN is not a valid invoice. Second, the reporting of invoice details in GST returns and the e-Way bill will be auto-captured based on the e-invoice data.

All in all, by just uploading your e-invoice data to IRP system, most of your compliance needs will be taken care of. That’s the level of technology at which the e-invoice system is being built by the government.

What does this change imply to businesses?

As they move forward, businesses should make provision for a new form of issuance of invoices and leverage the benefit of technology with which the e-invoice system is built. Just like any new system, e-invoice too requires businesses to be prepared and smoothly transit.

In a bid to help the businesses to transit smoothly to e-invoicing, the next section highlights the key things businesses should take care of.

How to transit to e-invoice system?

The first step towards preparing your business for e-invoicing system is to know and understand the e-invoice system. Understanding the fundamentals and how the e-invoice system works will help you identify the requirements and fill gaps. This also calls for educating your internal teams about the change in the invoice process that comes with e-invoice.

Secondly, the accounting software you use will play a key role in e-invoice system. The new system requires you to upload and authenticate the invoice with IRN. Accounting software or ERP that seamlessly interacts with the IRP system will make the task of e-invoicing easier.

Here are the key things the accounting software is expected to do.

- Generating e-Invoice Data

You need to upload e-invoice data in JSON format as per the schema provided. Here, the accounting software should generate e-invoice JSON from the invoice details recorded as per the e-invoice standards. e-invoice standard consists of mandatory and optional fields and the accounting software should be able to cater to it considering your business necessities.

- Seamless Integration with IRP System

After you create an invoice with the help of your accounting software, you will have to upload such an invoice on the IRP portal for validation and generating IRN. Here, the accounting software should have the in-built capability to interact with the IRP system and upload the e-invoice JSON without manual intervention. This will not only save your time but also increases the efficiency in invoice processing.

- Download and Capture IRN

Once an invoice generated by you sails through the IRP portal, on its return, e-invoice JSON will be digitally signed and added with new elements such as IRN number and QR Code. The accounting software should be able to download the digitally signed JSON and accordingly incorporate the IRN and other details into the invoice you issue to your customer.

Sugam GST Returns – Form GST RET-3

The new GST return framework has introduced a set of return forms specially designed for small taxpayers. Among the new returns available, Sugam return form is once such GST return aims to simplify the GST complexities.

In this blog, let us discuss and understand Sugam returns, return filing periodicity, tax payment, format and filing process.

What is Sugam GST returns?

Sugam is a new GST return for small taxpayers whose aggregate turnover in the financial year does not exceed 5 Crores and their outward supplies consist of B2B as well as B2C. Businesses opting Sugam GST returns will be allowed to make outward supplies to end consumers, unregistered business and business registered under GST.

Applicability of Sugam return

To opt Sugam return under GST, you need to satisfy the below two conditions.

- The aggregate turnover in the previous financial years is up to 5 crores

- You are engaged in making B2B supplies (Unregistered Business and end consumers) and B2B supplies (supplies to business registered under GST)

Periodicity of filing Sugam return

The periodicity of Sugam return filing is on a quarterly basis with a monthly payment of tax. For businesses opting Sugam GST return, the due date to file a quarterly return is 25th of the subsequent month following the quarter-end.

The due date for filing Sugam GST returns is given below

| Due Date to File Sugam GST Return | |

| Filing Period | Due Data |

| April -June | 25th July |

| July – September | 25th October |

| October- December | 25th January |

| January-March | 25th April |

Due date for payment of tax

Though the return filing periodicity is quarterly, businesses opting Sugam return are required to make the monthly payment.

The tax payment is on the self-assessed basis and the payment declaration challan known as Form GST PMT -08 should be used to remit the payment. The due date to remit the monthly payment is 20th of the subsequent month.

Like Sahaj return, the self-assessed payment is required only for 1st and 2nd month of the and for 3rd month, payment with all adjustments should be made along with the returns.

Let’s understand with an example.

For April to June quarter, the taxpayer needs to remit the tax of April by 20th May and May’s tax by 20th June. For June, you need to pay tax along with first 2 months adjustment (if any) with main Sugam returns.

Difference between Sahaj and Sugam GST returns

While both the returns are quarterly and applicable for small taxpayers, basis the supplies nature it supports, these 2 differs. Sahaj as a small taxpayer return supports only B2C supplies whereas Sugam supports B2C as well as B2B supplies.

In other words, Sahaj return is suitable for businesses who are engaged in making only B2C outward supplies. On the other hand, Sugam is suitable for a business who make both B2C as well as B2B supplies.

Types of supplies allowed under Sugam returns

The following table gives the list of supplies allowed and disallowed under Sugam GST returns.

| Type of Outward Supplies | Allowed (Yes) / Disallowed (No) |

| B2B transactions | Yes |

| B2C transactions | Yes |

| Exports | No |

| SEZ units/developers | No |

| Deemed Exports | No |

| Outward Supply to e-Commerce Operators | No |

| Nil Rated, Exempted or Non – GST | Yes |

| Inward supplies attracting RCM | Yes |

| Import of goods/services | No |

| Import of Goods from SEZ | No |

Sugam return filing process

The Sugam GST returns consist of one main return, to be filed on a quarterly basis supported by two main annexures. Form GST RET-3 is the return form to be used to file Sugam returns supported by the annexures.

The details of return forms and annexures to be used for filling Sugam return is given below.

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-3 | Form RET-3 is a quarterly return applicable for business opting Sugam returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

The key point which businesses should take note is that the option to avail input tax credit on the missing invoices (invoices not uploaded by the supplier) is not available in Sugam returns. This implies that businesses will be allowed to avail the ITC to the extent of the invoices auto-populated in Form GST ANX-II.

However, the option to claim ITC on a provisional basis on the missing invoice is available for taxpayers opting monthly return and quarterly normal return using Form GST RET-1.

Format of Sugam returns – Form GST RET – 03

The Sugam form RET – 03 contains the details of supplies (both inward and outward) declared through Form GST ANX – 1 and GST ANX – 2. This is the main return form which auto-populates the information of supplies from the first two annexure forms. The supplier (taxpayer) needs to complete the remaining details and calculate their tax liability.

To summarize the Sugam return format (Form GST RET-3), it contains the summary level details of outward supplies, inward supplies and adjustments related to it. The Sugam return format consists of the following details:

- Outward supplies

- Inward supplies attracting reverse charge

- Debit/credit notes

- Advanced received

- Total tax liability

- Inward supplies for claiming ITC

- Net ITC available

- Amount of TDS/TCS credit received (Transition / Switchover)

- Interest and late fee (if any) and

- Final payable tax along with details of tax payment and

- Refund claimed from the ledger.

Sahaj GST Returns – Form GST RET-2

By Introducing different return forms for different types of business, the new GST return system aims to simplify the filing process for business registered under GST. Sahaj GST return is one such form among the several types of new GST returns to be introduced.

In this blog, let us understand all about the Sahaj GST returns right from its applicability, periodicity of return filing, payment of tax and return filing process.

What is Sahaj return in GST?

Sahaj is a type of GST returns for small taxpayers whose aggregate turnover in the financial year does not exceed 5 Crores and their outward supplies are of B2C nature i.e. outward supplies are made to end consumers and unregistered business.

Applicability of Sahaj return

The criteria to decide on the applicability of the return depends on the aggregate turnover and types of outward supplies you make.

- The aggregate turnover in the previous financial years is up to 5 crores

- You are engaged in making only B2B supplies (Unregistered Business and end consumers)

If you satisfy the above two conditions, you will have an option to file Sahaj GST returns.

Periodicity of filing Sahaj return

The periodicity of Sahaj return filing is on a quarterly basis. However, the payment of tax should be made on a monthly basis.

For businesses opting Sahaj GST return, the due date to file a quarterly return is 25th of the subsequent month following the quarter-end. Following are due date for filing Sahaj returns.

| Due Date to File Sahaj GST Return | |

| Quarters | Due Data |

| April -June | 25th July |

| July – September | 25th October |

| October- December | 25th January |

| January-March | 25th April |

Due date for payment of tax

Taxpayers opting Sahaj return are required to make the monthly payment though the return filing periodicity is quarterly. The payment of tax is on the self-assessed basis and should be made through a payment declaration form known as Form GST PMT-08. The due date for monthly payment of tax for Sahaj return is 20th of succeeding month.

The self-assessed payment is required only for 1st and 2nd month of the quarter and for 3rd month, payment along with all adjustments should be made along with the returns.

Sahaj return filing process

The Sahaj GST return consist of one main return, to be filed on a quarterly basis supported by two main annexures. Form GST RET-2 is the return form to be used to file Sahaj returns supported by the annexures.

The details of return forms and annexures to be used for filling Sahaj return is given below.

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-2 | Form RET-02 is a quarterly return applicable for business opting Sahaj returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

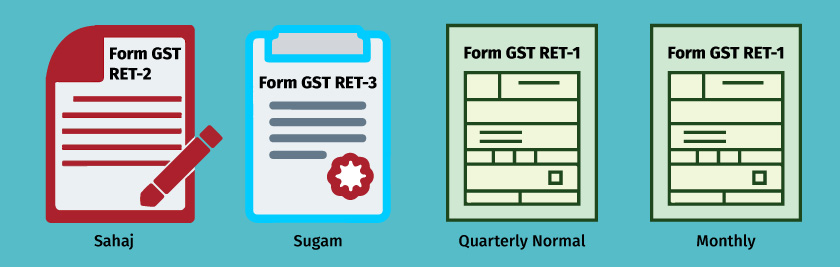

Types of New GST Return Forms and Annexures

In a bid to simplify the GST compliance, the GST Council has proposed the new GST returns expected to be introduced from 1st October,2020.  Considering the diversity of businesses operating in the country, different returns forms supported with annexure are proposed as a part new return framework.

while the idea of different returns for different business aims at simplifying the GST compliance, businesses are recommended to carefully asses the business profile, their vendors, supply type etc. and accordingly choose the one which suits the most.

Having said there are different returns, the immediate question which comes to mind is what are the returns that are available on the GST shelf? Which return should I shop on the GST portal?

Let’s understand the different returns forms and annexures introduced in the new GST returns.

Return forms and Annexure in new GST Returns

| Form | Description | Action |

| Form GST ANX- I | Form GST ANX-1 is an annexure of outward supplies and inward supplies attracting reverse charge. | You need to upload details of outward supplies along with purchases attracting reverse charge in FORM GST ANX – 1 |

| Form GST ANX – II | It’s an annexure containing details of auto-drafted inward supplies.

|

Form GST ANX-II is an auto-populated annexure containing the details of document uploaded by your supplier on a real-time basis.

Here you can either accept, modify or reject the invoice uploaded by your counterpart (seller) for confirming the ITC. |

| Form RET-1 (Monthly) | Form RET-1 is a monthly return to be filed by the businesses having aggregate turnover over more than 5 Crores in a financial year. | Business needs to file the monthly return by 20th of the subsequent month. |

| Form RET-2 | Form RET-2 is a quarterly return applicable for business opting Sahaj returns (Up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

| Form RET-03 | Form RET-02 is a quarterly return applicable for business opting Sugam returns (up to 5 Crores) | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

| Form RET-1(Quarterly) | This is similar to monthly return but applicable for business having aggregate turnover up to 5 crores. | Business need to file the monthly return by 25th of the subsequent month following the quarter-end |

As detailed in the above table, the main return will be supported by the annexures. Every return is supported by two annexures, one for reporting the outward supplies (liability) and the other one for inward supplies (ITC).

Among the main returns, you need to choose and file only one return which is suitable for your business profile.  Choosing the right GST return is key for simplification and assessing your business profile inline with new return types is must. This because each return form has its own implication on the Input tax credit.

Highlights of New GST Returns

The new GST returns proposed to be introduced on 1st October,2020, aims to drastically reduce the complexities attached to GST compliance in the current day. In order to allow businesses to get used to new returns, a trail functionality has been enabled on the GST common portal.

The prototype of new GST returns will enable the businesses to experience and learn the new functionality before it goes live. Before you get your hands into the prototype of new GST returns, it is recommended to know few key aspects of new GST returns.

Here are the key highlights of all-new simplified GST return which will come into effect from 1st April, 2020.

Classification of Taxpayers

Under the new GST return framework, the taxpayers are classified into small Taxpayers and large taxpayers. Small taxpayers are those having annual turnover up to 5Cr in previous financial year and taxpayers having a turnover of more than 5 Cr in a previous financial year are treated as large taxpayers.

This change will widen the small taxpayer’s bracket eligible for quarterly returns from the existing threshold of 1.5 Cr. The increased threshold will ensure that around 90% of businesses will benefit the simpler compliance under the new GST return framework.

Single GST Return

Single GST return is introduced with the concept of outward annexure (Form GST ANX-1) and inward annexure (Form GST ANX-II). In outward annexure, the businesses are required to admit the liability by furnishing the outward supplies and inward supplies attracting reverse charge. In-turn, these details will be auto-populated into your main return.

On the other hand, inward annexure will capture the details of purchases for claiming the input tax credit. This annexure will be auto-populated based on the invoices uploaded by your supplier. Like Form GST Anx-1, these details too will be auto-populated into main GST return.

The new GST return framework will significantly reduce the efforts and time required for filing returns as most of the details required are auto-populated into the main returns.

Different Types of New GST Returns

Based on the size the businesses, the type of supplies, customers you deal and the geography, the GST council has designed different type of GST Returns. Sahaj, Sugam and quarterly normal returns are the quarterly return available for small taxpayers. Monthly return (Form GST RET-1) for larger taxpayers.

The returns are so simple that it requires only fewer details basis the business profile and the compliance requirements in relation to ITC are very minimum. It is expected that the cost of compliance will be less.

Profile Based Returns Format

Instead of having a common GST return format for all, the council has designed different type of GST returns considering the diversity of business operations. This comes with the option to personalize the return format based on the supplies you make.

As a result, only the relevant information will be shown based on the business profile. For example, a small manufacturer or trader, buying and selling locally may need to file a return consisting of only fewer information.

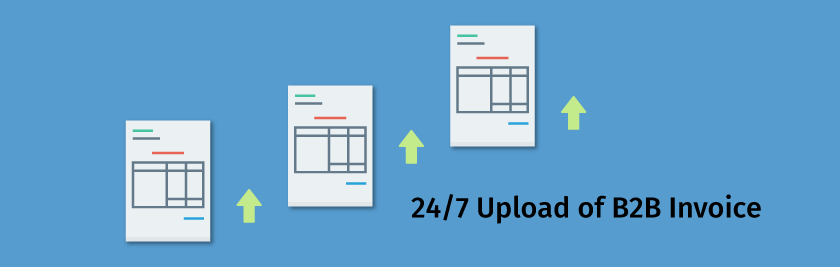

Continuous Upload of Invoice

The new GST return is provisioned for continuous uploading of invoices by the supplier anytime during the month. At the end of the filing period, these invoices will be auto-populated in the return.

By just uploading the Invoices, most of your work-related return filing is done and at the end of the return period, it becomes so simple that you can validate with your tax expert and file the return.

Viewing facility of Invoices    Â

Based on the invoices uploaded by your supplier, the real-time viewing facility of invoices is made available to the buyer. This achieved by auto-populating the details of the invoices uploaded by the supplier into the inward supplies’ annexure known as Form GST ANX-II. This also comes with an option for looking of invoice.

This will help you to verify and lock the invoice to confirm the eligible ITC. Locking of invoice will ensure that invoices uploaded by your supplier is correct and the invoice will be locked for further modification by the supplier. Thus, the risk of ITC loss in a certain business situation is mitigated.

Amendment of Returns and invoice

The concept of revised returns to be introduced and you will be allowed to revise return for any tax period. Returns will be revised either by filing amendment returns or reporting of missing invoice. Â Provision to revise the current returns (GSTR-1 and GSTR-3B) is not available.

Also, amendment (editing) of invoice by the supplier is provisioned in the new GST return framework. The supplier can edit only if the invoice has not been locked by the recipient. If it is already locked, unless it is reset/unlocked by the recipient, the details cannot be edited by the supplier.

No Automatic Reversal of ITC

No automatic reversal of input tax credit at the recipient’s end in the case of default in the payment of tax by the supplier. In such situations, recovery efforts will be first made from the supplier.

ITC on Missing Invoice

Invoices or debit notes which have not been uploaded by the supplier, the recipient is allowed to avail input tax credit (ITC) on a provisional basis in the same month and a window of 2 tax period are allowed to report such missing invoice.

The facility of availing ITC and reporting is allowed for Larger taxpayers (Monthly returns) and small taxpayers filing RET-1 (quarterly normal return). In other words, businesses who have opted Sahaj return and Sugam return will not be allowed avail ITC on the missing invoice.

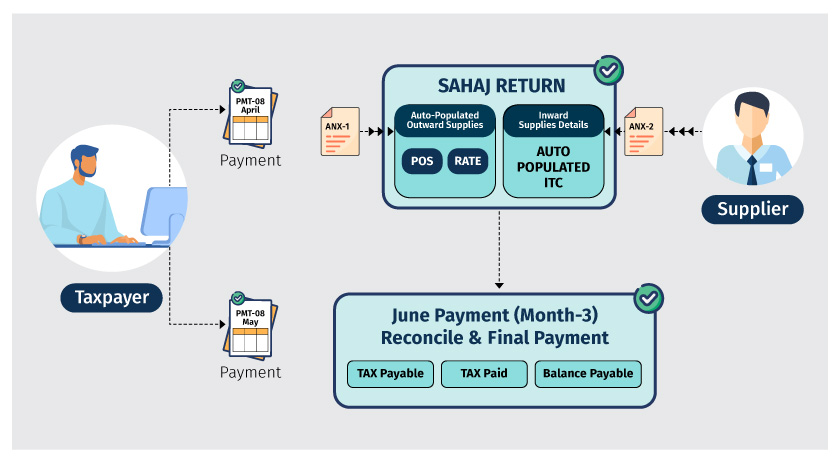

How to File GST Sahaj Return in Form RET-2

The Sahaj return is a quarterly GST return to be filed by 20th of the subsequent quarter. The businesses whose turnover in the previous financial year is up to 5 Crores and engaged in making outward supplies only to B2C i.e. end consumers or unregistered businesses can opt to file GST Sahaj return. The form to be filed by businesses opting Sahaj is Form RET-2

Though the Sahaj return in form RET-2 filing is on a quarterly basis, the payment of GST needs to be made on monthly basis using the payment declaration form known as Form GST PMT-08. The businesses need to determine the tax liability and Input tax credit on the self-assessed basis and accordingly remit it through Form GST PMT-08

Let’s understand the complete Sahaj return filing Cycle.

How to file Sahaj Return in Form RET-2

The details of outward supplies in GST Sahaj form are required only at a summary level. This is because, GST Sahaj is applicable only if you are making B2C supplies and your customer (the buyer) will not be in a position to claim ITC on the supplies made by you.

The GST Sahaj return filing cycle through Form RET-02 is explained with an illustration.

We have considered the April-June, 2019 to explain the GST Sahaj return filing cycle. In the above illustration:

- The taxpayer makes the self-assessed payment for the month of April, 2019 and May, 2019 using Payment Declaration Form GST PMT-08

- On completion of the quarter April to June, 2019, GST Sahaj return needs to be filed by 20th of July 2019 with the payment of Tax

- Â The taxpayer needs to furnish the consolidated outward supplies details at rate-wise (5%, 12% etc.) and place of supply-wise in Form GST ANX-1. This, in turn, gets auto-populated into the Sahaj return Form GST RET-2

- Input Tax credit details will be auto populated in Sahaj return form RET-2

- As illustrated, as and when the invoices are uploaded by the supplier, details of ITC will be auto-captured in inward supplies annexure ‘ANX-02’ and which in turn gets auto-populated in GST Sahaj return form.

- Remember, Sahaj returns forms will not have a concept of claiming and reporting ITC on missing invoices which supplier has not uploaded. You can claim the ITC only to the extent of invoice uploaded by the supplier

- Once the required details are furnished in GST Sahaj return, the next step is to make payment

- The tax payment here includes:

- Tax payable for supplies made during 3rd month of the quarter

- Adjustment due to the difference in tax paid on the self-assessed basis in the first and second month versus the outward supplies’ details declared in the Sahaj return.

- Adjustment due to ITC claimed on self-assessed basis versus the auto-populated ITC available in inward supplies annexure.

- Once the tax payment is done, you can submit and file the GST Sahaj returns.

Conclusion

For businesses, the Sahaj return filing cycle is very simple. All you have to do is the self-assessed monthly payment and mention the consolidated details of outward supplies in annexure -1. The rest of the details are auto-populated in Sahaj return. The businesses can leverage on simplification only when they carefully assess their businesses profile and choose the one which is suitable.